European shares stabilized on Friday as eyes turned to US jobs data expected later. Investors assessed the Bank of England’s biggest rate hike in 27 years amid growing fears of a recession. By 0705 GMT, the pan-European Stoxx 600 index settled, amid fears of slowing growth in the world’s largest …

Read More »Dow Jones repeats the upside ahead of US data 5/8/2022

Oil, Crude, trading

Read More »GBP/JPY: may witness a temporary rise 5/8/2022

GBP/JPY was able to achieve the bearish targets within the expected negative outlook during the previous analysis, touching the second leg of 161.50, and recording the lowest 161.10 On the technical side today, and with a closer look at the 60-minute chart, we find signs of positivity starting to appear …

Read More »CAD tests resistance for the third consecutive session 5/8/2022

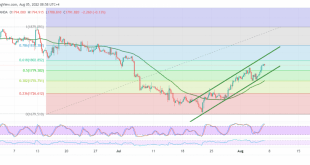

The loonie’s movement has changed little and is still hovering below the pivotal resistance level 1.2880 that it has been unable to breach. Technically, we tend to the negativity, relying on the support of the 50-day simple moving average for the bearish bias, which is exerting negative pressure on the …

Read More »GBP is looking for a clearer path 5/8/2022

Oil, Crude, trading

Read More »Gold hits target, eyes on data 5/8/2022

Gold prices continued to rise gradually to the upside, as we expected, heading to touch the official target station yesterday at 1794, recording its highest level at 1794. Technically, and by looking at the 240-minute chart, we find the 50-day simple moving average that enhances the chances of rising, in …

Read More »Euro Touches the target 5/8/2022

A positive trading session witnessed the movements of the euro against the US dollar within the expected bullish bias during the previous analysis, touching the retest target that is required to be achieved over the short time intervals at 1.0210, recording the highest level at 1.0253. Technically, we find the …

Read More »Market Drivers – US Session – August, 4

The dollar fell against most of its major rival currencies, ending the trading day near its latest lows. This constitutes a sign of additional declines ahead in the near term.AUD/USD advanced and hovers around 0.6970, helped by gold, as the bright metal reached fresh one-month highs in the $1,790 price …

Read More »WTI pressured around $87.80 amid recession fears

WTI crude oil holds lower ground near six-month bottom after declining for the last four days. Fears of economic slowdown, central bank aggression outweigh geopolitical woes linked to China, Russia. US jobs report for July as well as developments surrounding China will be important for fresh impulse. WTI crude oil …

Read More »USD/CHF turns sideways ahead of NFP data

The USD/CHF pair is wavering in an 11-pip range as investors await the important NFP data in the US. Estimated 200k for the NFP could even drag the asset lower. The Dollar Index failed to capitalize on a wave of hawkish commentary from several Fed policymakers.The USD/CHF pair is displaying …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations