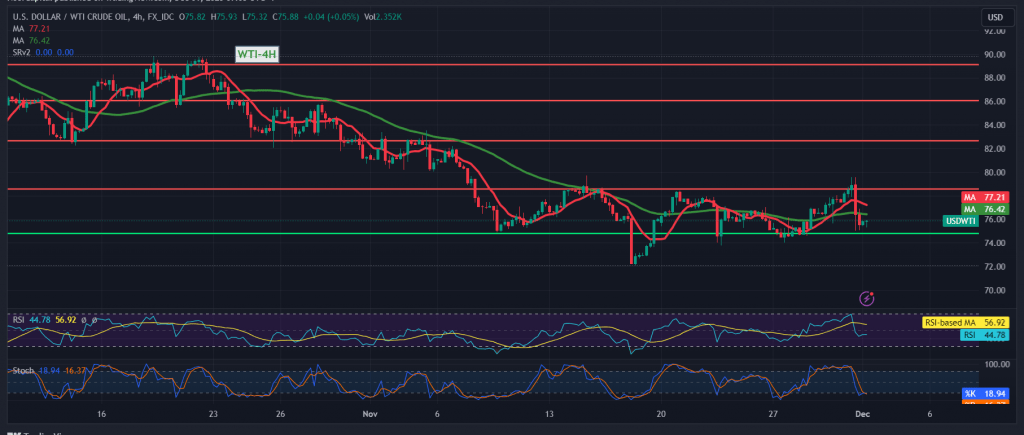

An upward trend dominated the price movements of US crude oil futures contracts, as anticipated, reaching the official target at $79.40 and marking its highest level at $79.65 per barrel.

However, technical analysis indicates that oil prices encountered strong resistance around $79.60, prompting a rapid reversal in the trend. Currently, prices are stabilizing around $75.90. Upon closer examination, it is observed that the price has returned to stability below the primary resistance, settling at current trading levels of $77.85, accompanied by the continued formation of simple moving averages. This suggests negative pressure, supporting the potential resumption of the decline.

While we lean towards a negative outlook, caution is advised. The initial target is set at $74.10, and a breakthrough may extend oil’s losses, opening the path directly towards $72.35.

To invalidate the downward trend, an upward crossover and rise above $77.85 are required. Such a move would lead to a recovery in oil prices, visiting $78.65 and $79.40 before determining the next price destination.

Warning: High-impact economic data is expected from the American economy today, including the Manufacturing Purchasing Managers’ Index issued by the ISM and a press talk by the Chairman of the Federal Reserve. Consequently, there may be high price volatility at the time of news release.

Warning: Risk levels may be high.

Warning: The overall risk may be elevated amid ongoing geopolitical tensions, contributing to potential high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations