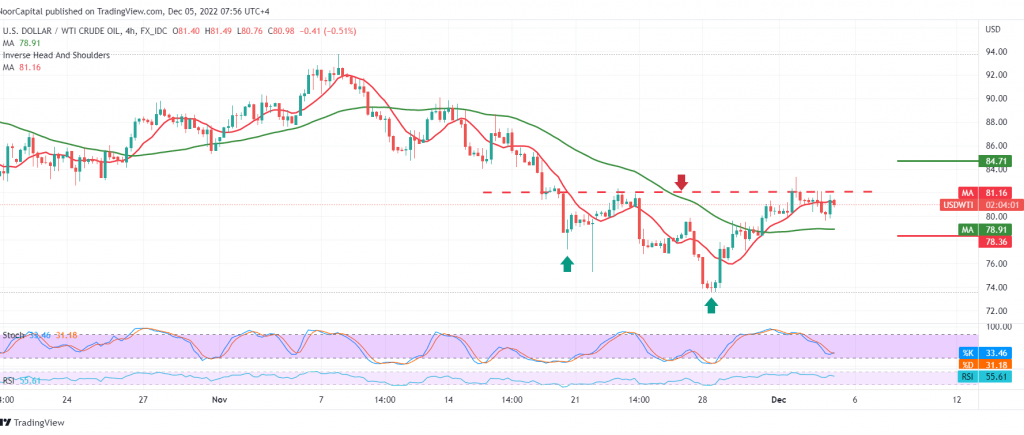

US crude oil prices achieved good gains by the end of the trading week ending last Friday, within the expected technical context during the previous report, surpassing the official target that should be touched at 81.60, recording its highest level at 82.20.

Technically, we tend to be optimistic but cautious, relying on price stability above the 50-day simple moving average, which supports the possibility of an upside. This comes in conjunction with stochastic attempts to eliminate the current negativity.

The consolidation of daily trading above the support floor of 79.70 increases the possibility of a rise. We only need to witness the consolidation of the price above the resistance level of 82.15, which is a catalyst factor that increases and accelerates the strength of the bullish daily trend, waiting for touching 83.40. The gains may extend later towards 84.70 next station, as long as trading is stable above 79.60.

Trading stability and the price’s stability below 79.60 will stop the idea of resuming the rise and put the price under strong negative pressure, with its initial targets at 78.30.

Note: The level of risk is high and may not be commensurate with the expected return on the European Union’s decision to put a ceiling on the price of Russian oil.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations