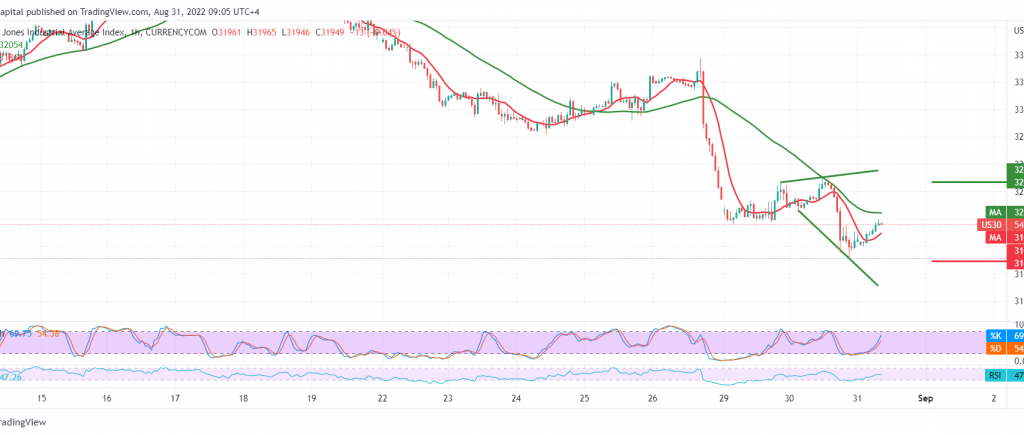

The Dow Jones Industrial Average temporarily reversed the expected direction. We made it clear that we depend on trading stability below 32,280 and that breaching it opens the door to form a minor bullish correction, its target at 32,325, to record 32,345, and then return to the expected daily bearish trend towards the desired bearish target 31,700, recording its lowest level at 31,615.

On the technical side, by looking at the 60-minute chart, we find that the RSI started sending positive signals, coinciding with the positivity features that started appearing on the stochastic indicator.

There is a possibility of a bullish slope in the coming hours, to retest 32,330 before starting the decline again, knowing that the bullish slope does not contradict the general bearish trend, which targets around 31,600 and breaking 31,600 extends the index’s losses, opening the door to visit 31,250.

Note: the risks are high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations