The Dow Jones Industrial Average continues to face downward pressure, weighed by deteriorating investor sentiment amid heightened geopolitical tensions.

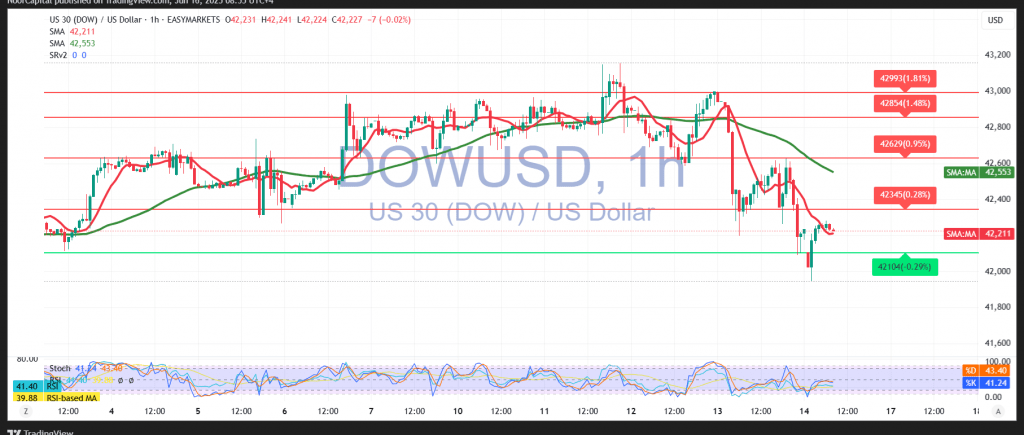

From a technical perspective, the 4-hour chart shows persistent bearish signals. The simple moving averages remain positioned above current price levels, acting as dynamic resistance and reinforcing the negative outlook. Additionally, the 14-day momentum indicator continues to trend lower, confirming ongoing selling momentum.

While the overall bias is bearish, caution is warranted. A confirmed break below the 41,950 level would strengthen the case for a further decline toward 42,070 as the first target. If 42,025 is breached, the index could see extended losses, with the next significant support found around 41,820.

Conversely, a sustained move back above 42,360 would invalidate the bearish scenario and signal a potential recovery toward 42,485.

Warning: Market conditions remain highly volatile amid persistent trade and geopolitical tensions. Risk levels are elevated, and all outcomes remain possible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations