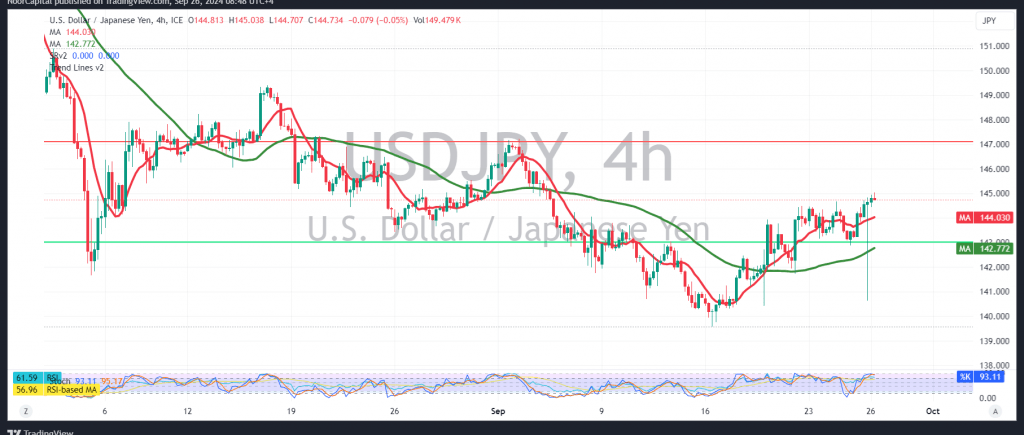

Mixed trading dominates the movements of the USD/JPY pair as it attempts to recover after breaching the resistance level of 144.10, reaching a high near 145.00.

From a technical standpoint today, and by closely examining the 240-minute chart, we lean towards a positive outlook but with caution, based on the positive signals from the simple moving averages, as well as the momentum indicator’s attempts to generate positive signals in the short term.

As long as trading remains stable above 144.00, this supports maintaining our positive expectations. A confirmed break above 145.55 would likely extend the pair’s gains, opening the way towards targets of 146.35 and 147.30.

On the downside, if the hourly candle closes below 144.00, this would halt the upward attempts, leading to a trading session in negative territory, initially targeting 143.40.

Warning: The risk level is high and may not be commensurate with the expected return.

Warning: Today, we anticipate high-impact economic data from the US, including the final reading of GDP prices, unemployment benefits, and a speech by Jerome Powell, Chairman of the Federal Reserve. This could result in high volatility at the time of the news release.

Warning: The risk level is high amid ongoing geopolitical tensions, and all scenarios are possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations