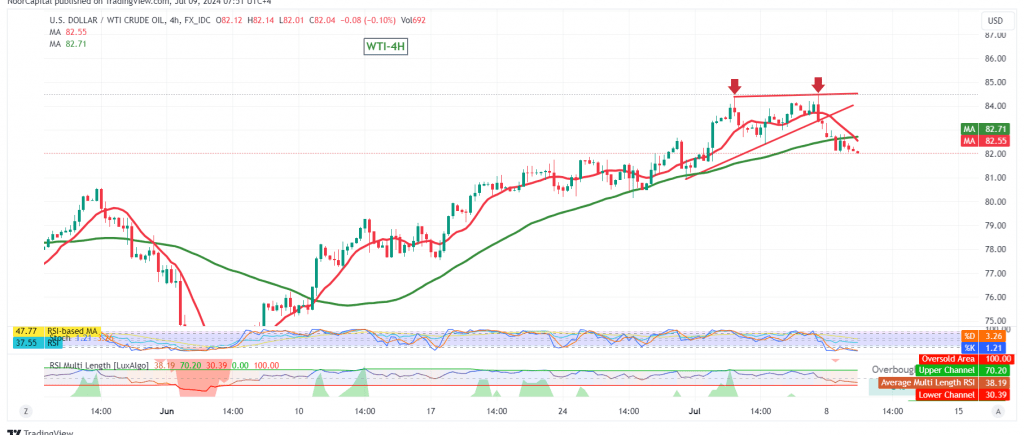

WTI crude oil experienced negative trading in the previous session, initiating a downward correction and touching the psychological support level of 82.00. The technical outlook now leans towards further downside potential.

Key Technical Signals:

- Breakdown of 82.70: A confirmed break below the 82.70 level, coupled with negative pressure from the simple moving averages and waning bullish momentum, suggests a potential continuation of the downward correction.

- Downward Targets: The primary target for this correction is 81.60. A break below this level could accelerate the decline, potentially targeting 81.20 and eventually 80.60.

Potential Bullish Reversal:

A return of trading stability above 82.85 could invalidate the bearish scenario and potentially reignite the upward trend towards 83.70.

Caution:

- High-Impact Economic Data: Today’s release of high-impact US economic data, including testimony from Fed Chairman Jerome Powell and a speech by the US Treasury Secretary, could introduce significant volatility into the market.

- Geopolitical Tensions: Ongoing geopolitical tensions further elevate the risk of heightened price fluctuations.

Overall Assessment:

The technical outlook for WTI crude oil has shifted towards a bearish correction, with potential for further downside movement if key support levels are breached. Traders should exercise caution due to the potential for volatility stemming from both economic data releases and geopolitical events. A break below 81.60 would confirm the continuation of the downward trend, while a recovery above 82.85 could signal a potential bullish reversal.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for WTI crude oil.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations