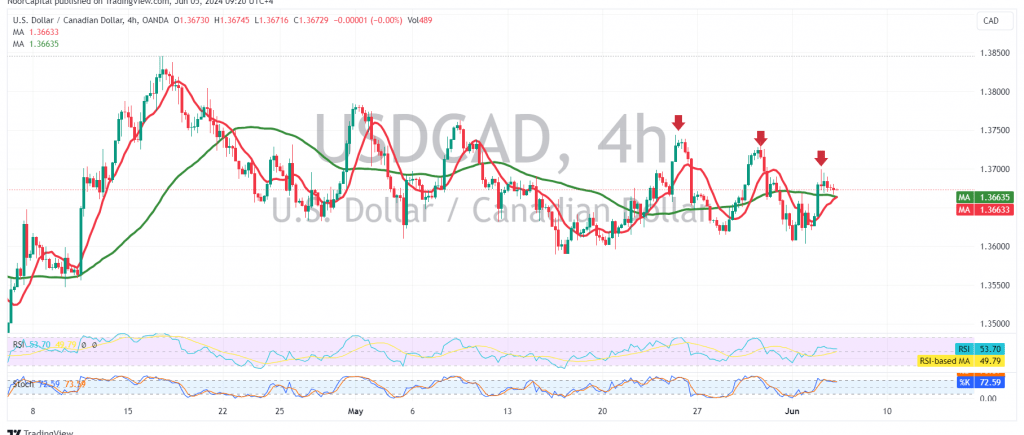

The Canadian dollar (CAD) witnessed positive trading in the previous session, but its upward momentum was curtailed by the pivotal resistance level of 1.3690. Technical indicators now suggest a potential shift towards a bearish trend.

The Stochastic oscillator on the 240-minute timeframe is showing signs of waning upward momentum, indicating a possible reversal in the pair’s trajectory. Moreover, the price remains below the 1.3690 resistance level, further reinforcing the bearish outlook.

Based on these technical signals, a downward trend is expected for today’s trading session. The initial target for this decline is 1.3630. A break below this level could accelerate the downward movement, potentially leading to a further drop towards 1.3590.

However, traders should remain cautious as a return of trading stability above 1.3690 could invalidate the bearish scenario. A decisive move above this level could trigger a bullish reversal, with the potential to push the pair towards 1.3740.

It’s crucial to note that the upcoming release of high-impact economic data from the U.S. economy, specifically the “Change in Non-Agricultural Private Sector Jobs” report, could introduce significant volatility into the market. This data could influence investor sentiment and potentially impact the Canadian dollar’s direction.

In conclusion, the CAD faces downward pressure in the short term, but a bullish reversal remains possible if the pair can break above the 1.3690 resistance level. Traders should exercise caution and closely monitor the market’s reaction to the upcoming U.S. economic data, which could significantly impact the pair’s trajectory.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations