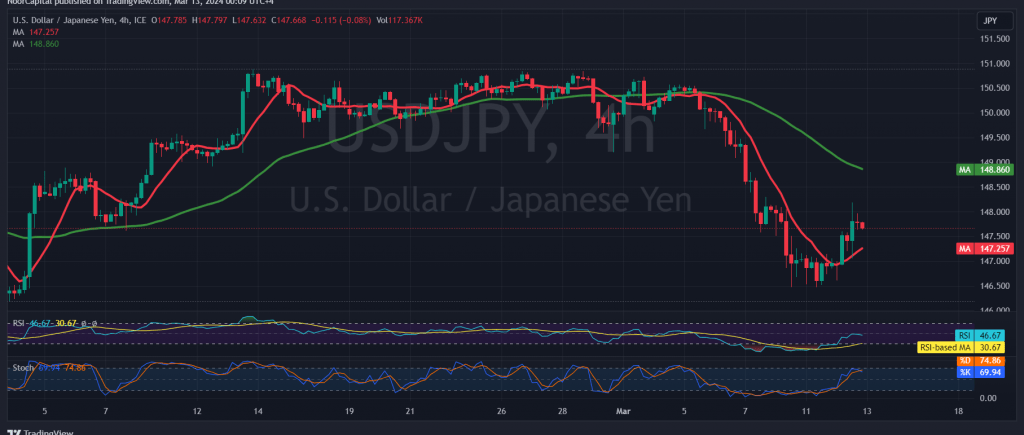

The USD/JPY pair has indeed fulfilled our previous technical expectations by rising and reaching the designated target of 147.90, nearly touching the subsequent level of 148.30 with a slight deviation, reaching a peak of 148.18.

Today’s technical analysis, conducted on the 4-hour chart, reveals persistent challenges for the pair. Despite its upward movement, the simple moving average continues to act as a barrier. Additionally, the pair has struggled to maintain stability above the psychological resistance level of 148.00 for an extended period.

The established bearish trend remains intact and influential, with initial targets set at 147.20 and 146.80. A breach below 146.80 would exacerbate the pair’s downward momentum, potentially leading to further losses and paving the way for a decline towards 145.90.

Conversely, a return to trading stability above the pivotal resistance level of 148.30 could invalidate the aforementioned bearish scenario. In such a case, the pair may experience a temporary upward trajectory, with a target set at 149.00.

Investors are cautioned about the potential high level of risk associated with trading, and the quality of transactions may not be optimal given the prevailing market conditions.

This analysis underscores the importance of monitoring key technical levels and trends for informed decision-making in trading USD/JPY pairs amidst evolving market dynamics.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations