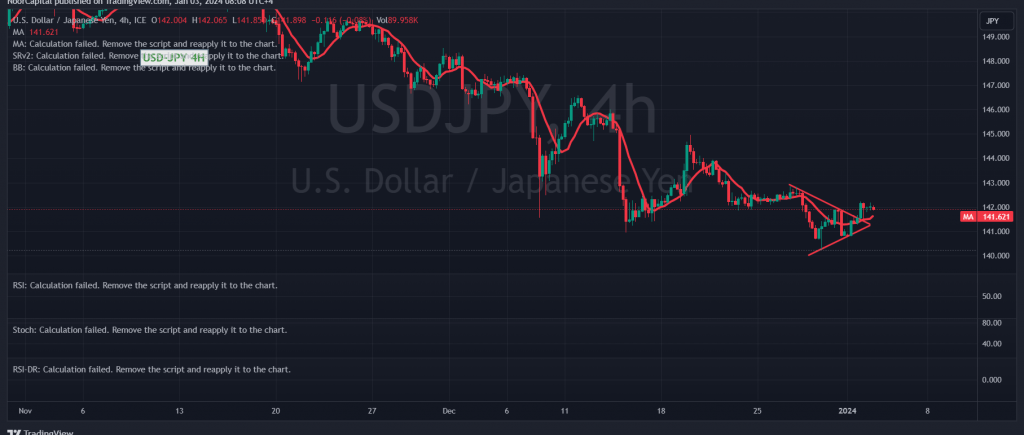

The USD/JPY pair exhibited positive movements in the previous trading session, finding solid support near 140.80 and attempting to retest 142.30.

From a technical perspective today, there is a possibility of a slight upward correction, contingent upon the pair receiving a positive stimulus from the 50-day simple moving average, coupled with clear positive signals on the 14-day momentum indicator.

Therefore, as long as trading remains above 141.10 and generally above 140.80, the upward bias is deemed preferable. A clear and robust breach of the main resistance level at 142.45 is anticipated, targeting 143.10 and 143.60, respectively.

Conversely, if trading stability returns below 140.80, the pair may continue along the official bearish path, with expectations of touching 140.20 and 139.60. Traders are advised to closely monitor these key levels and technical indicators to navigate potential market movements effectively.

A cautionary note is warranted today as high-impact economic data related to the American economy (FOMC Minutes, ISM Manufacturing PMI, and JOLTS Job Openings) is anticipated. This may result in increased volatility during the release of these news items. Traders are advised to exercise vigilance and consider the potential market reactions to these events.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations