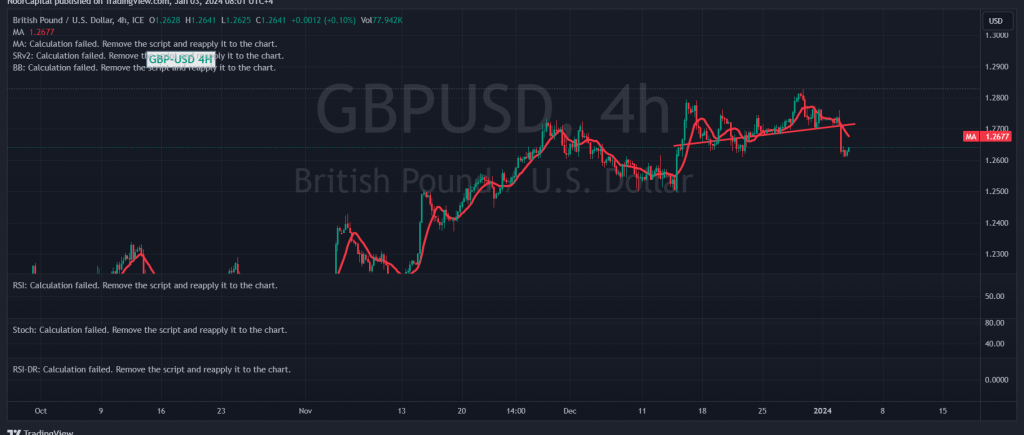

At the outset of the previous trading session, the British pound successfully reached the initial target at the price of 1.2760, marking its highest level at 1.2760. However, this level acted as a formidable resistance, prompting the pair to trade negatively during the middle of the session. It was emphasized in the earlier analysis that trading below 1.2700, especially with the closing of the hourly candle, postpones the chances of a rise but does not eliminate them. The forecast included the possibility of a bearish tendency with the aim of retesting 1.2660, recording its lowest trading level at 1.2611.

From a technical standpoint today, the bias is leaning towards negativity, with a reliance on the return of the simple moving averages to exert pressure on the price from above. This is concurrent with the confirmation of the pair breaking the support floor of 1.2700, and more crucially, 1.2730.

Therefore, the preference is for a resumption of the downward path, targeting 1.2580. Special attention should be paid if the mentioned level is breached, given its significance to the general trend in the immediate term. Breaking below it could extend losses towards 1.2520 initially.

It is crucial to note that a return to trading stability above 1.2700 and, more importantly, 1.2730 has the potential to thwart the proposed scenario, and the pair may recover to complete the upward path towards 1.2830, serving as a significant resistance level. Traders are advised to closely monitor these key levels for potential market developments.

A cautionary note is warranted today as high-impact economic data related to the American economy (FOMC Minutes, ISM Manufacturing PMI, and JOLTS Job Openings) is anticipated. This may result in increased volatility during the release of these news items. Traders are advised to exercise vigilance and consider the potential market reactions to these events.

Traders are advised to be vigilant as the risk level is deemed high in the current market conditions. It’s crucial to closely monitor developments and adjust strategies accordingly.

A cautionary note is warranted as the risk level is deemed high, underscoring the importance of vigilance in the current market conditions.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations