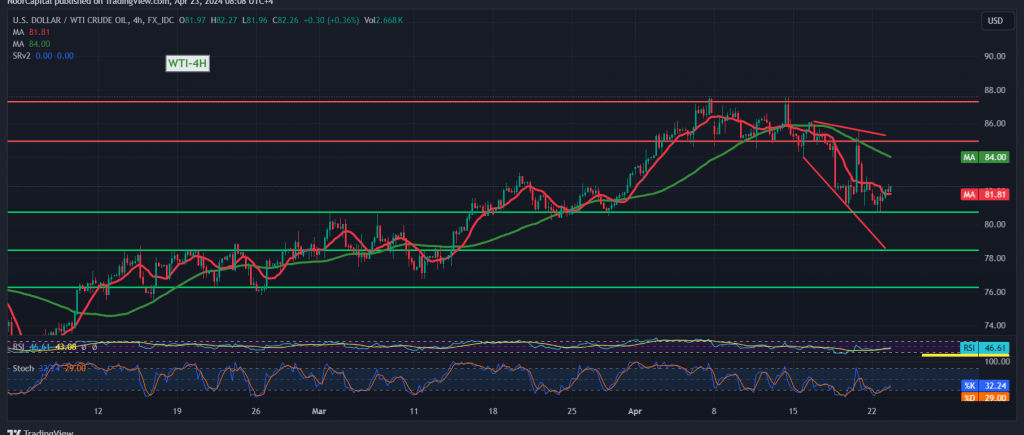

During the previous trading session, US crude oil futures contracts experienced negative pressure, aligning with the bearish context anticipated in the preceding technical report. The prices touched the first target at $80.40, reaching a low of $80.47 per barrel.

From a technical standpoint, the price remains stable below the 50-day simple moving average, which continues to exert downward pressure and acts as a barrier to price movements. Additionally, the Stochastic indicator has lost bullish momentum over the 4-hour timeframe.

As long as intraday trading remains below 82.70, the corrective decline is likely to persist, targeting 81.20 and then 80.10 as the next significant level. It’s crucial to note that breaching the psychological support level of $80.00 could intensify the downward correction, potentially leading to a direct descent towards $79.50.

Conversely, closing at least an hour candle above 82.85 could postpone the likelihood of further declines. Temporary recovery attempts may occur, aiming to retest the resistance at 83.40 before determining the next price destination.

Risk Advisory: Investors should exercise caution given the potential high risk, particularly amidst ongoing geopolitical tensions, which could contribute to heightened price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations