The Nasdaq index successfully reached the first official target as outlined in the previous technical report, attaining a high of 17,996.

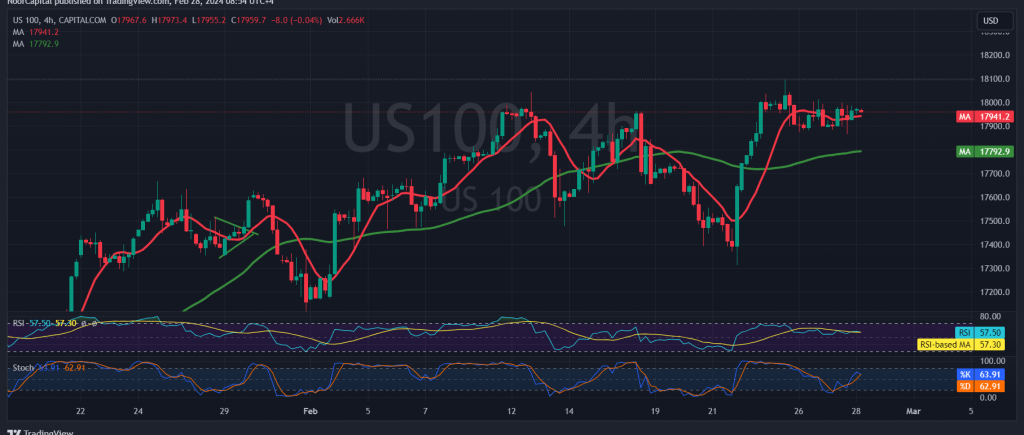

Today’s technical analysis, focusing on the 240-minute timeframe chart, indicates sustained stability in the index’s movements above the 50-day simple moving average. Additionally, the Relative Strength Index shows efforts to support the continuation of the upward trend.

As such, the potential for further increases remains viable, provided that daily trading maintains levels above 17,880. The initial target remains at 17,990, with a breakthrough enhancing the index’s gains and paving the way for a move towards 18,015 and 18,070.

Conversely, a breach below 17,880, coupled with the closure of an hourly candle below this level, would invalidate the upward momentum, subjecting the index to temporary negative pressure, with a target set at 17,810.

A word of caution: Today’s trading activity is influenced by the impending release of highly influential economic data from the American economy, particularly the Consumer Confidence Index. Consequently, heightened volatility is anticipated at the time of the news release.

Furthermore, it is essential to acknowledge the elevated risk environment amidst ongoing geopolitical tensions, which may contribute to increased price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations