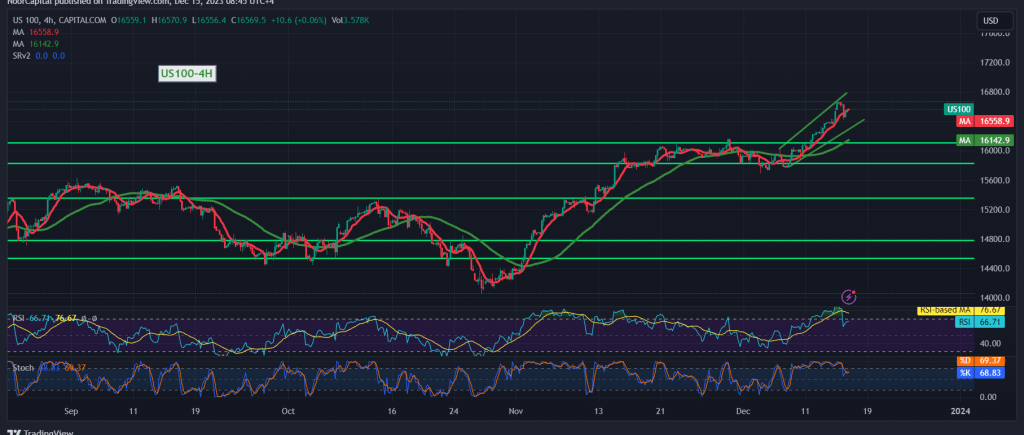

The Nasdaq index exhibited a blend of trading dynamics in the previous session, marked by mixed movements, encountering resistance around the 16660 level that effectively curtailed the bullish sentiment.

From a technical standpoint, the upward trajectory remains intact, bolstered by positive momentum emanating from the simple moving averages lifting the price from below. This positive sentiment is further supported by the 14-day momentum indicator’s efforts to gain positive momentum.

Consequently, the prevailing preference leans towards the continuation of the upward trend for the day. It’s noteworthy that the consolidation of the price above 16665 facilitates the path to reach 16685 as the initial target, with subsequent gains extending towards 16800.

A crucial reminder is that a return to daily trading stability below 16450 would defer the prospects of an upward move, subjecting the index to temporary negative pressure, with a target set at 16300.

It’s important to exercise caution as risks are deemed high. The overall risk level is elevated, particularly given ongoing geopolitical tensions, and there is the potential for heightened price volatility. Vigilance and prudent risk management are strongly advised in such circumstances.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations