The EUR/USD pair has been exhibiting a relatively subdued trading pattern with a slight inclination towards positive movements, consistently testing the robust resistance level positioned at 1.0960, which it has yet to breach.

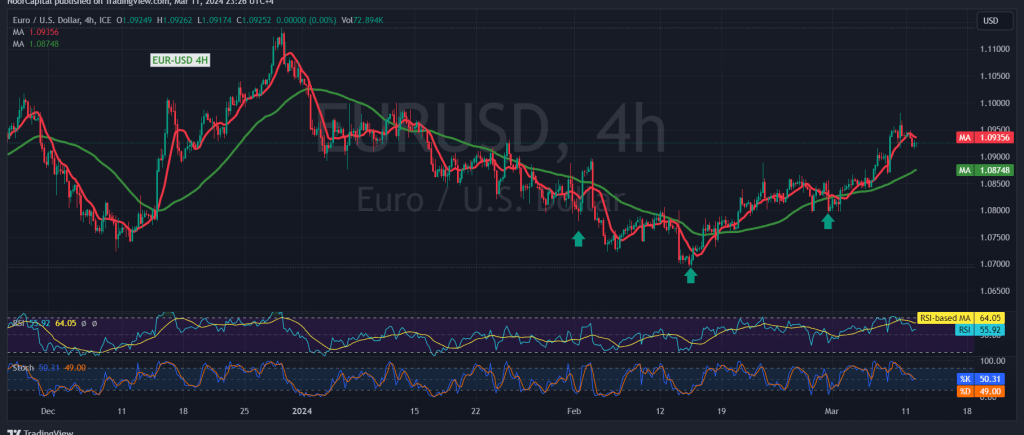

Examining the technical landscape today, particularly on the 240-minute timeframe chart, it is evident that the simple moving averages continue to provide underlying support to the price action from below. This reaffirms the prevailing bullish technical framework, as depicted in the chart.

In this context, the daily trading activity maintains its position above the formidable support threshold at 1.0860, thereby sustaining the viability of the bullish scenario. The initial target remains at 1.0960, and a successful breach of this level would further reinforce and expedite the upward momentum, potentially paving the way for additional gains towards 1.1030. Subsequently, investors are eyeing 1.1070 as a significant milestone in the upward trajectory.

However, it’s crucial to note that a dip below the 1.0860 support level would revive concerns regarding a potential shift towards a bearish bias. In such a scenario, attention would turn towards the 1.0810 level to ascertain the next probable price direction.

Additionally, it’s prudent to exercise caution today due to the release of high-impact economic data from both the United States and the United Kingdom. Specifically, market participants are awaiting updates on core consumer prices on a monthly and annual basis from the US, excluding food and energy, along with monthly and annual consumer prices. Furthermore, attention will be on the UK’s index of change in unemployment benefits. These data releases may trigger significant price fluctuations, warranting vigilance during their announcement.

A word of caution: Today’s trading landscape is punctuated by the release of impactful economic data emanating from the American economy, notably the “Consumer Confidence Index.” Consequently, heightened volatility is anticipated upon the dissemination of this news.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations