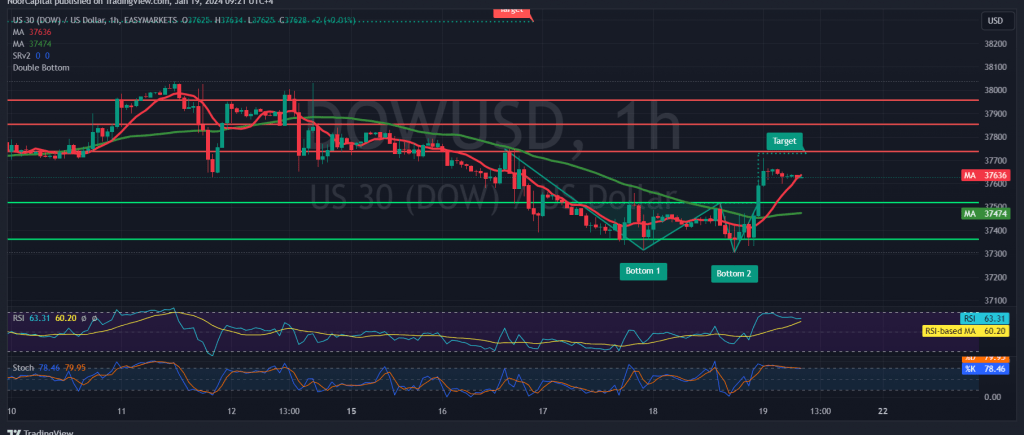

The Dow Jones Industrial Average witnessed mixed trading in the previous session, operating within the anticipated bearish context and touching the first target early in the American trading period at a price of 37330, reaching its lowest level of 37309.

Technically, the index experienced an upward rebound during the American period, prompted by the support around 37310. A closer examination of the 4-hour chart leads us to a cautious positive outlook, contingent on intraday stability above the support level of 37520. This level is calculated with the index receiving a positive boost from the 50-day simple moving average.

Hence, the preference is for an upward bias, with an initial target set at 37790. A breach of this level has the potential to bolster the index’s gains, paving the way for a visit to 37950.

Conversely, a return to trading stability below 37750 would reintroduce negative pressure on the index, with an initial target of 37380.

Risk Warning: The risk level is elevated, particularly amidst ongoing geopolitical tensions, and traders should be prepared for the possibility of heightened price volatility. Caution and prudent risk management are advisable.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations