Wages are vital for maintaining living standards in daily life and, since they make up around 60% of GDP in the US, the UK, and the Eurozone, they are also critical for controlling inflation in the financial markets.

Price rises will eventually result from rapid pay increases since wage growth is hard to quantify and can be twisted by conceptual differences, low-quality household surveys, and shifting workforce compositions. While wage growth continues to exceed the long-term level consistent with globally stable inflation, all US metrics are quickly approaching this target.

Evidence points to the UK as well, but there hasn’t been much of a rise in wages. The headline data for the Eurozone for the third quarter of 2023 is incredibly outdated, and wages are also adjusting to the previous energy crisis, pandemic, and inflationary era.

US wages have dropped far behind those in the Eurozone while approximately keeping up with costs. This was anticipated as US inflation was more demand-driven and because European consumers would have to significantly lower their standard of living in 2022 due to sharply rising import energy prices.

Almost exactly the same shock that hit the Eurozone hit the UK, although since the end of 2019, earnings there have increased more quickly than in the US, keeping up with prices.

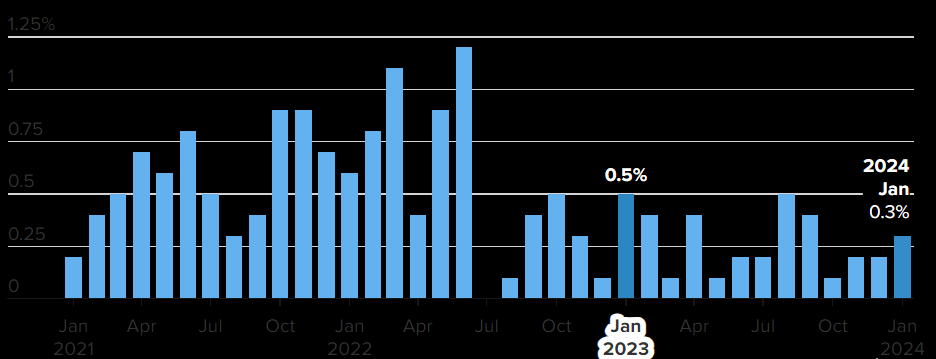

US Consumer Price Index – Month-over-month percent change Source: BLS

The productivity adjustment that is required is for wages to increase in line with both productivity growth and inflation. Since late 2019, the GDP per employee in Europe has barely increased, which is far worse than the productivity growth—while still far from robust—in the US.

This means that the US can expand its wages faster than Europe without experiencing additional inflation, which accounts for a large portion of the US-Eurozone divide.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations