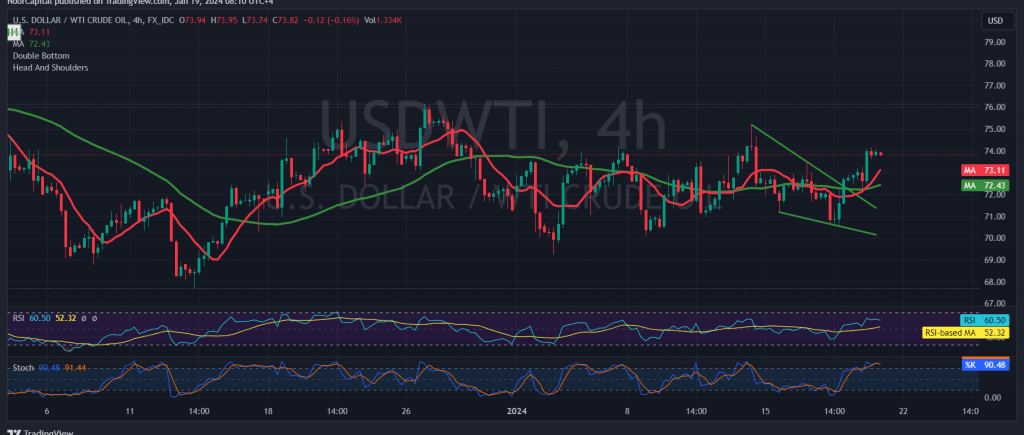

In our recent technical report, we maintained a neutral stance due to conflicting technical signals. We highlighted the pivotal role of breaching the 73.50 resistance level for any upward movement, potentially leading to an increase to 74.40. Consequently, US crude oil futures recorded their highest level at approximately $74.20 per barrel.

Upon examining the 4-hour chart, the return of the simple moving averages from below is noteworthy, continuing to provide positive momentum for prices. This aligns with clear positive signals on the 14-day momentum indicator.

In the event of intraday trading stability above the 73.50 resistance, there exists the possibility of reaching 74.65 as the initial target. It’s important to consider that an upward surge and consolidation above 74.65 would act as a catalyst, further enhancing and expediting the strength of the intraday upward trend, with an anticipated record of 75.40.

A cautionary reminder is in place: a breach below 72.60 has the potential to undermine upward attempts, subjecting the price to robust negative pressure and signaling a continuation of the established downward trajectory. Initial targets in this scenario are situated at 71.40, extending towards 70.60.

Risk Warning: Negative signals from the Stochastic indicator on short time intervals should be taken into account. Additionally, the level of risk remains elevated amid ongoing geopolitical tensions, potentially resulting in heightened price volatility. Prudent risk management is advised.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations