The Canadian dollar continues to exhibit an upward trend, in line with the anticipated bullish context outlined in the previous technical report. The pair successfully established a base around the support level of 1.3320.

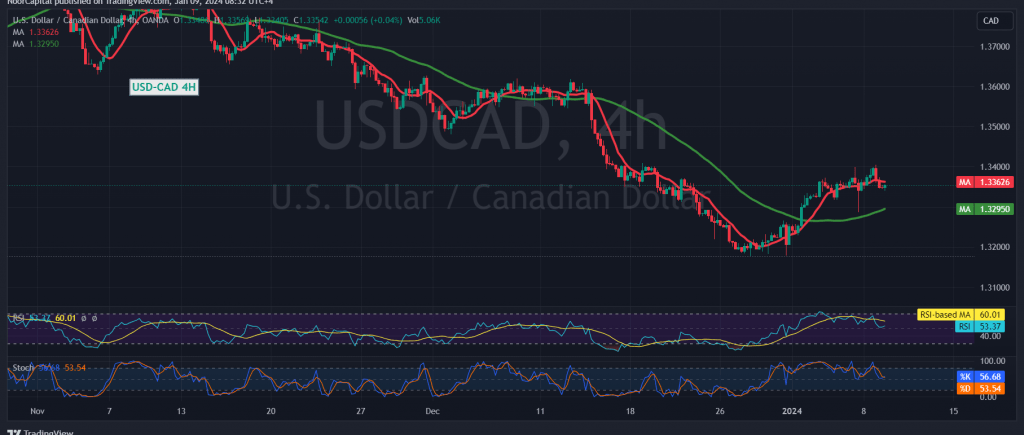

In terms of technical analysis, a closer examination of the 4-hour time frame chart reveals ongoing positive signals from the Relative Strength Index (RSI). Additionally, the pair is receiving positive reinforcement from the 50-day simple moving average.

With trading stability maintained above 1.3220, the positive expectations persist. The initial target is set at 1.3400, and surpassing this level could serve as a catalyst for further upward movement towards 1.3430 and 1.3460, respectively.

However, if the support floor at 1.3320 is breached, confirmed by the closing of at least a one-hour candle, the likelihood of a rise diminishes. In such a scenario, a retest of 1.3265 and 1.3230 may be observed before any potential resumption of the upward trajectory. Traders are advised to monitor price movements closely for informed decision-making.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations