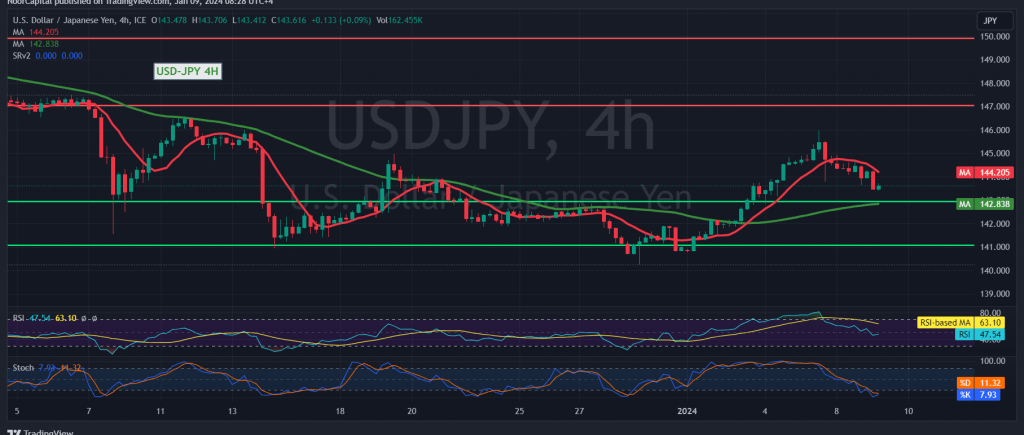

The USD/JPY pair experienced mixed trading in the previous session, encountering resistance near the psychological level of 145.00, ultimately resulting in negative movements.

From a technical perspective, conflicting signals are apparent. The 50-day simple moving average is attempting to provide a positive incentive, while the Stochastic indicator is yielding negative signals.

Monitoring the price behavior is crucial to discern one of the following scenarios:

- Upward Scenario: For an upward trend, it is essential to observe the price consolidating above 144.00. If this occurs, the pair could target 144.50 and subsequently 145.00.

- Downward Scenario: Should the price fall below 143.00, it would likely signify a continuation of the downward trajectory. In such a case, the pair may target 142.45 and 141.60.

Traders are advised to stay vigilant and responsive to the evolving price movements to make informed decisions based on the unfolding market dynamics.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations