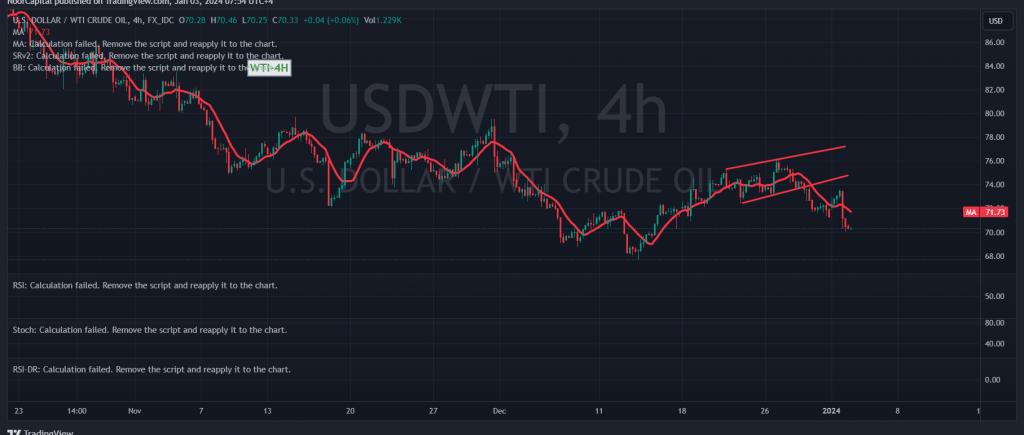

Oil prices did not align with the positive outlook as anticipated, which was based on the assumption of trading stability above the psychological barrier support level of 71.00 at the time of the report’s issuance. The report highlighted that a return to trading stability below 71.00 would cease attempts to rise, leading oil to complete the downward path with initial targets starting at 68.10, marking its lowest level at $70.10 per barrel.

From a technical perspective, the negative pressure from simple moving averages was mentioned, along with the confirmation of oil breaking the 71.10 support floor and transforming it into a resistance level.

As a result, the potential for the resumption of the downward trend is suggested, contingent upon witnessing a break of 70.00. Such a development would amplify and accelerate the strength of the downward trend, targeting 69.10 as the initial objective, with the possibility of further losses extending towards 68.10.

On the upside, consolidation of the price above 71.20 would promptly halt the proposed scenario. In this case, recovery attempts would be anticipated, commencing with positive targets around 72.60.

Traders are advised to closely monitor these key levels and technical indicators to navigate potential market movements effectively.

A cautionary note is warranted today as high-impact economic data related to the American economy (FOMC Minutes, ISM Manufacturing PMI, and JOLTS Job Openings) is anticipated. This may result in increased volatility during the release of these news items. Traders are advised to exercise vigilance and consider the potential market reactions to these events.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations