As we expected, the EUR/USD pair has traded positively since the beginning of the previous trading session within the bullish path, gradually rising to its highest level at 1.0694.

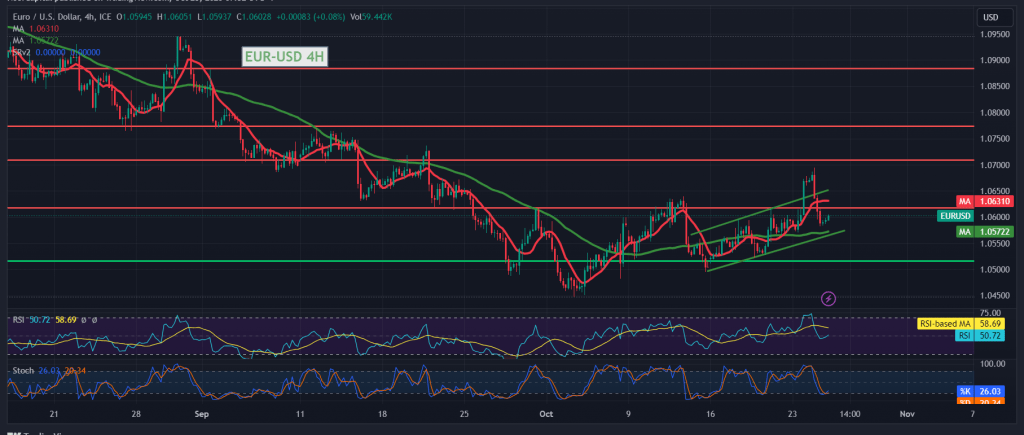

Technically, the euro found strong resistance near the psychological barrier of 1.0700 during mid-trading, which forced it to trade negatively to retest the previously breached resistance of 1.0600. Looking closely at the 240-minute time frame chart, we find the 50-day simple moving average still holding the price from Below, supported by the positive signs that began to appear on the 14-day momentum indicator.

From here, with the price consolidating intraday above 1.0600, and in general above 1.0570, the upward trend is the most preferred during the day, provided that we witness a breach of 1.0620, and this may facilitate the task required to visit 1.0670 as a first target, and the gains extend later towards 1.0700 and 1.0740.

Trading stability below 1.0560 invalidates the activation of the proposed scenario and leads the pair to trade negatively with a target of 1.0515.

Note: Today, the markets are awaiting high-impact data issued by the Canadian economy, represented by the Bank of Canada’s monetary policy report, interest statement, and interest rate decision, in addition to the speeches of the chairman of the Federal Reserve and the European Central Bank. We may witness fluctuation in the markets during the release of these data.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations