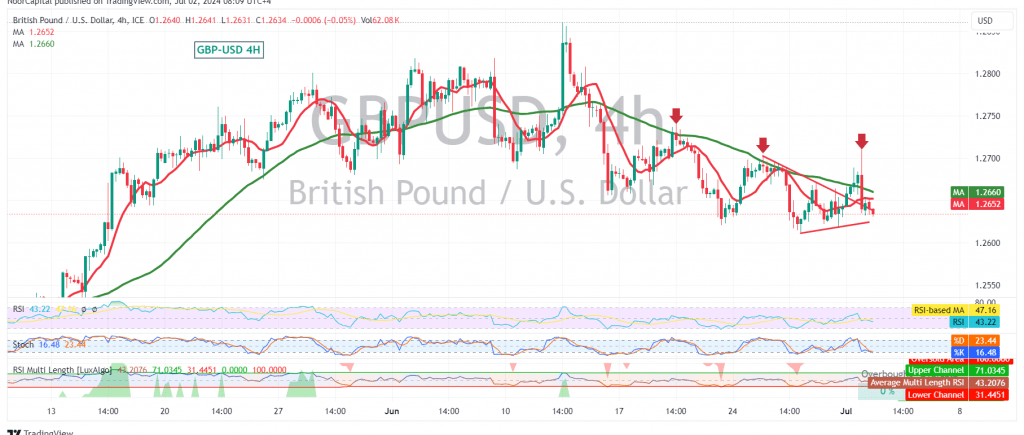

The British pound (GBP) declined against the US dollar (USD), reaching our previously identified target of 1.2630, confirming the bearish trend outlined in the last technical report.

Technical Outlook:

The GBP/USD pair remains below the key psychological resistance level of 1.2700, with the simple moving averages (SMAs) continuing to exert downward pressure. The Stochastic oscillator also indicates negative momentum, further reinforcing the bearish outlook.

Downward Potential:

The bearish trend is expected to persist today. A break below 1.2600 would likely accelerate the decline, with potential targets at 1.2570 and 1.2530.

Potential Reversal:

Traders should be aware that a close above 1.2700 on the hourly chart could signal a temporary recovery, potentially targeting 1.2750 and 1.2790.

Key Levels:

- Resistance: 1.2700, 1.2750, 1.2790

- Support: 1.2630, 1.2600, 1.2570, 1.2530

Important Note:

The release of high-impact U.S. economic data today, including job vacancies and labor turnover rate, along with a speech by the Federal Reserve Chairman, could significantly impact the pair’s movement. Traders should exercise caution and closely monitor market reactions to these news releases.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations