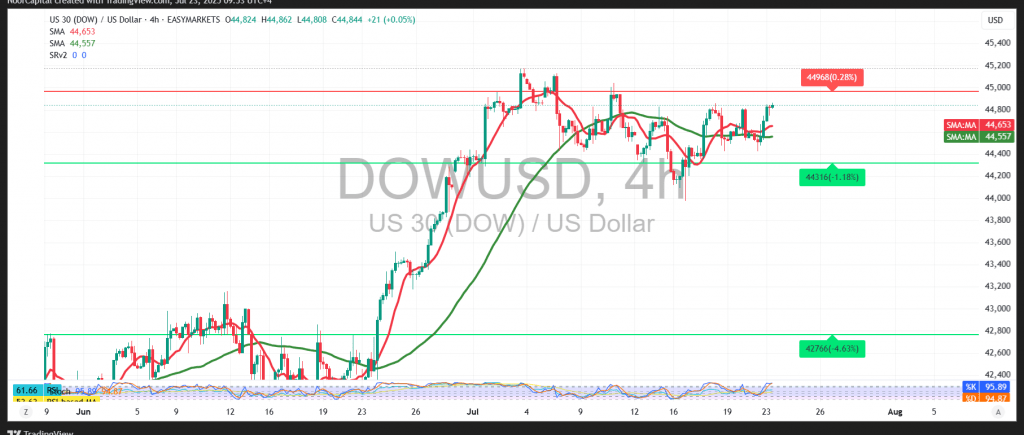

Dow Jones Industrial Average – Technical Analysis (4-Hour Chart)

The Dow Jones Industrial Average recorded strong gains on Wall Street for the second consecutive session, reaching a new high of 44,862.

Technical Outlook for Today’s Session:

Technically, the simple moving averages continue to provide positive momentum, acting as dynamic support levels and supporting the ongoing bullish trend. Additionally, the Relative Strength Index (RSI) is showing positive signals, reinforcing the likelihood of further upward movement.

Likely Scenario – Bullish Bias:

On the 4-hour timeframe, as long as the index holds above the 44,600 support level, the bullish trend remains favored, with immediate upside targets at:

- 45,000 (psychological resistance)

- A confirmed break above 45,000 would likely accelerate the rally toward 45,150

Alternative Scenario – Near-Term Pullback:

If the price fails to maintain support at 44,600, this could expose the index to downside pressure, targeting:

- 44,560 as a potential intraday support level

Caution:

Risk remains elevated amid ongoing geopolitical and trade tensions. Traders should prepare for potential volatility, and apply disciplined risk management.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations