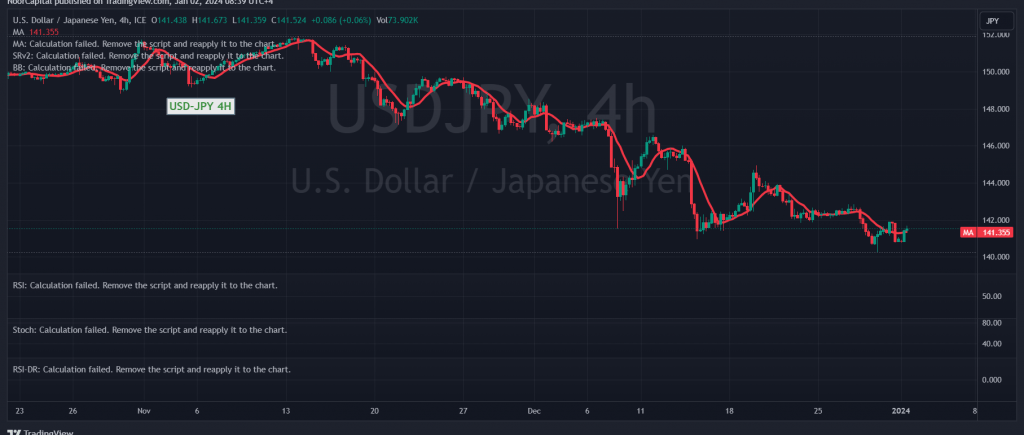

The dollar pair remains under the influence of a persistent downward trend, aligning with the bearish expectations outlined in the previous technical report, culminating in reaching the targeted level at 140.70, with its lowest point marked at 140.25.

Examining the technical aspects today, a negative bias prevails, with emphasis placed on the pair’s confirmation in breaching the support-turned-resistance level at 142.30. Furthermore, the ongoing formation of simple moving averages serves as a hindrance to the price, reinforcing the negative outlook.

As such, the prevailing inclination is towards a continued downward trend in today’s session, with the initial target set at 140.55. A breach of this level is anticipated to extend the pair’s losses, paving the way directly towards 139.60, a highly anticipated support station.

From an alternative perspective, a break above and a resurgence beyond 142.35 may temporarily defer the downside opportunities without completely negating them. In such a scenario, there might be attempts to retest the level at 142.85.

It’s crucial to note that the risk level is potentially high. Traders are urged to exercise caution and remain vigilant as market conditions evolve, and the outlined warnings should be duly considered in crafting trading strategies.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations