The USD/JPY pair successfully reached the first target outlined in the previous report, hitting 147.20 and registering its lowest point at 147.23.

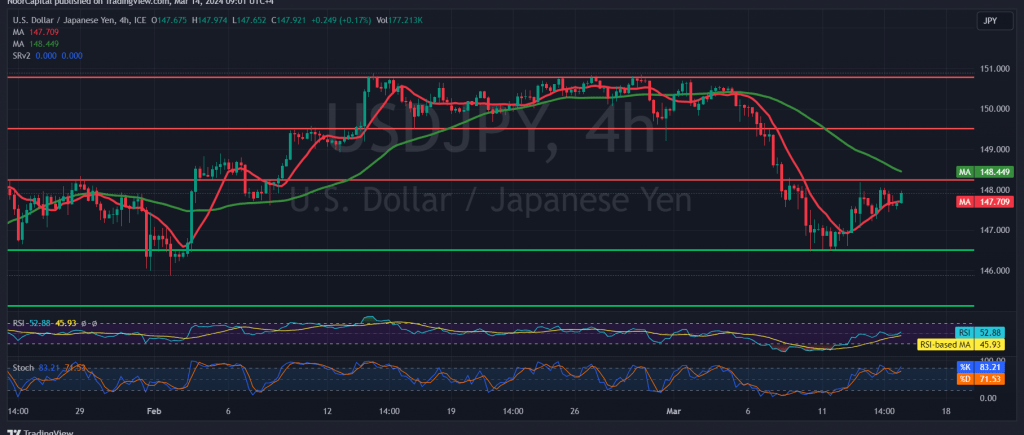

Technically, there was a rebound in the pair’s value following the attainment of the support level, allowing it to retest 148.00. Upon closer examination of the 4-hour chart, it is evident that the 50-day simple moving average continues to exert pressure from above. Additionally, there has been a gradual increase in momentum observed in the Stochastic indicator.

Therefore, the stability of intraday trading below 148.30 reinforces our inclination towards a downward correction. Initial targets for this correction are set at 147.20 and 146.90, as long as trading remains below 148.30. However, breaching this level would invalidate the downward correction scenario, potentially pushing the pair towards 149.00.

Investors should exercise caution, especially considering the high-impact economic data expected from the American economy today, including core monthly and annual producer prices, producer prices, and retail sales. These releases may contribute to increased price volatility.

Given the potential for market fluctuations, investors should be mindful of the associated risks and consider implementing appropriate risk management strategies to navigate the markets effectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations