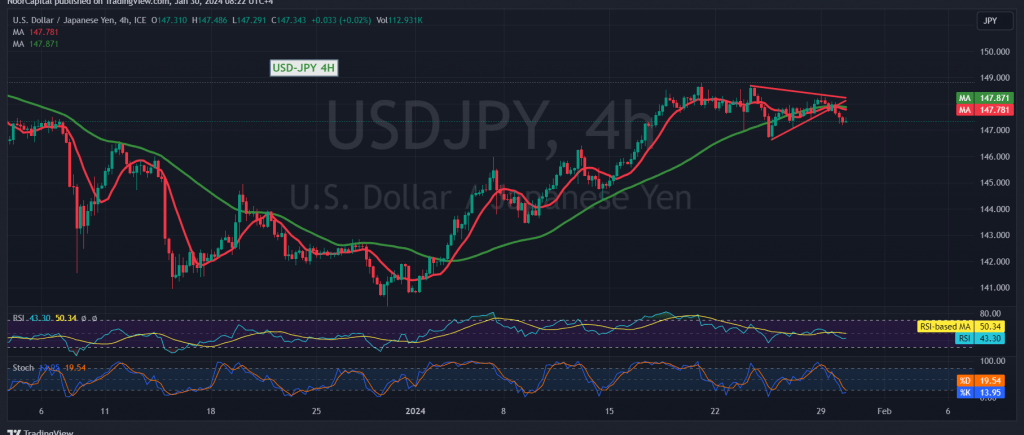

The USD/JPY pair experienced a downward trend in its movements yesterday, primarily due to encountering strong resistance at the psychological barrier of 148.00. This resistance level prompted a reversal, leading the pair to form a downward slope and reaching its lowest point at 147.20.

From a technical perspective today, the 4-hour chart shows the 50-day simple moving average exerting downward pressure on the price. Additionally, there are clear negative signals on the Relative Strength Index (RSI), which remains stable below the 50 midline.

There is a potential for the downward trend to continue in the coming hours, contingent upon a break below 147.20. Such a move would pave the way for a visit to the first target at 146.90, and further losses could extend towards 146.50 before a potential upward reversal.

Conversely, a reversal from the downside would require the pair to move above the psychological barrier resistance level of 148.00. Such a move would immediately negate the possibility of further decline, allowing the pair to resume its official upward trajectory. In this scenario, we would be looking for initial targets at 148.75 and 149.20.

It’s essential to exercise caution today as we await the release of high-impact economic data related to the US economy—the Consumer Confidence Index. The time of the news release may lead to increased price volatility.

Warning: The risk level may be high, especially considering ongoing geopolitical tensions, which could contribute to heightened price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations