The pound sterling found support at the 1.2670 level during the previous analysis, effectively curbing the bearish momentum against the US dollar. The current movements indicate stability above this mentioned support level, maintaining the existing technical outlook.

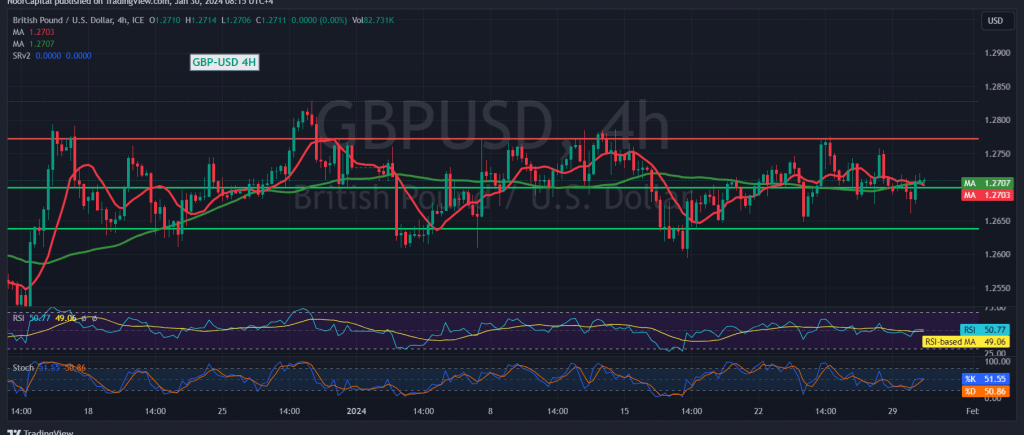

Technically, the pair is presently hovering above the 50-day simple moving average, which appears to be exerting upward pressure on the price. A closer look at the 4-hour chart reveals the Stochastic indicator attempting to shed its current negativity. The pair remains stable above the 1.2680 support level.

With these factors in mind, the most likely scenario is an upward bias, contingent on a clear and robust breach of the main resistance level at 1.2730. Such a move could extend the pair’s gains, targeting 1.2780 and 1.2820, respectively.

It’s crucial to note that a return to trading stability below the robust support level of 1.2650 could shift the pair into a downward trend, with initial targets at 1.2580 and potential extensions toward 1.2550.

Caution is advised as we await the release of high-impact economic data related to the US economy—the Consumer Confidence Index today. The time of the news release may witness heightened price volatility.

Warning: The risk level may be high, especially in the context of ongoing geopolitical tensions, leading to potential high price volatility.

A cautionary note is warranted as the risk level is deemed high, underscoring the importance of vigilance in the current market conditions.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations