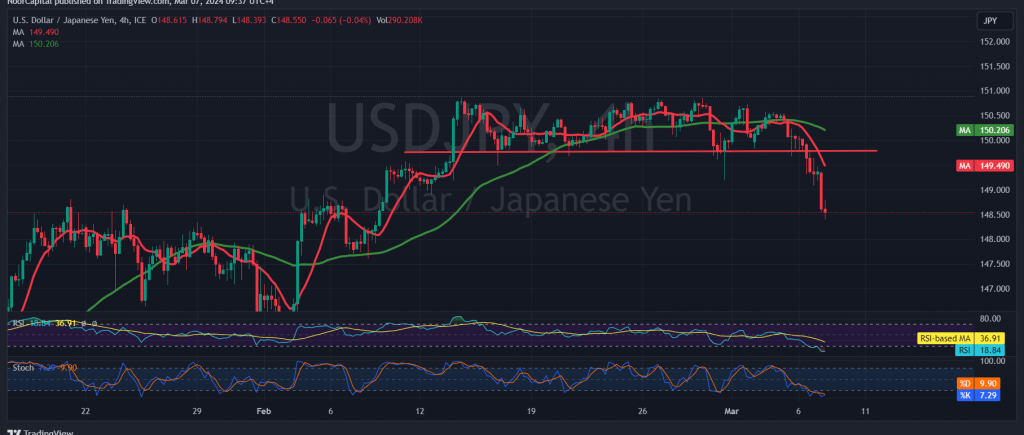

In recent sessions, we’ve maintained a neutral stance as the pair’s movements remained confined within a sideways price range, with the lower boundary above 149.70 and the upper boundary below 150.80. We’ve highlighted that a breach below 149.70 would likely steer the pair towards a downward trajectory, with initial targets around 149.10 and 148.80, with the lowest level recorded at the onset of the current session at 148.40.

Today’s technical analysis reveals a continuation of the downward correction after the pair failed to sustain trading above 149.70. Additionally, the return of simple moving averages has exerted pressure on the price from above.

Hence, the possibility of a further corrective decline remains valid, with targets set at 147.95/148.00 as the initial objective. A breach of this level could extend the losses, potentially leading to a visit to 147.35.

Conversely, an upward crossover and consolidation above the previously breached support-turned-resistance level at 149.70 could disrupt the bearish scenario, prompting a recovery towards a retest of 150.80.

It’s crucial to exercise caution today as we anticipate high-impact economic data releases from both the Eurozone and the United States. This includes the Eurozone’s interest rate and monetary policy statement from the European Central Bank, as well as the ECB’s press conference. Additionally, we await the testimony of the Chairman of the Federal Reserve from the United States, which may induce significant price fluctuations upon release.

Given the potential for heightened risk, it’s advisable to proceed with caution and remain vigilant amidst market uncertainties.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations