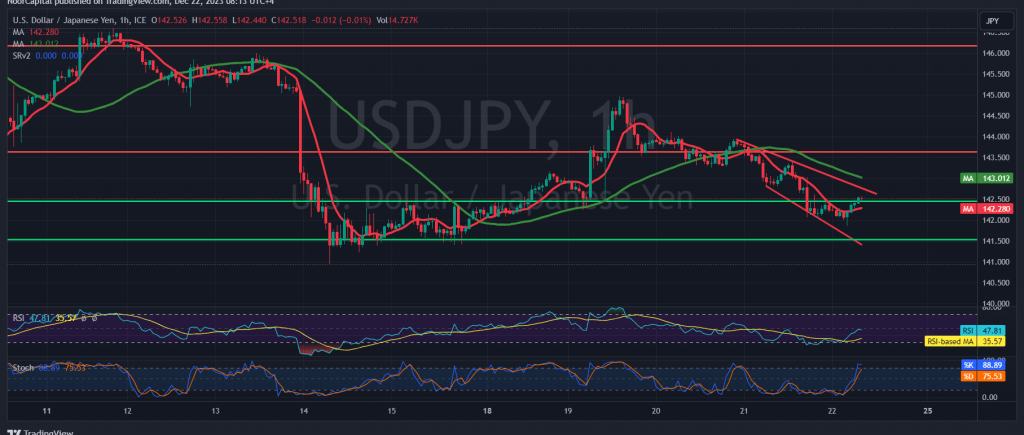

A bearish trend dominated the movements of the USD/JPY pair within the anticipated downward context, reaching the officially designated targets of 142.45 and 141.90 yesterday and recording a low of 141.86.

From a technical standpoint, intraday movements are displaying an upward bias following contact with the robust support level represented by the second target at 141.90. Upon closer examination, it is observed that the Stochastic indicator has started to lose upward momentum. Simultaneously, the ongoing formation of simple moving averages adds a negative pressure factor from above.

Consequently, the likelihood of a continued downward trend remains high. Confirmation of a break below the formidable support at 141.70 would increase and accelerate the strength of the downward trend, paving the way directly towards the initial target of 140.90.

Only an upward surge with price consolidation above 143.45 has the potential to disrupt the proposed scenario, leading the pair to temporarily recover towards 144.40 before the resumption of the decline.

Warning: Today, high-impact economic data is anticipated from the American economy, including “annual/monthly core personal consumer spending prices” and “Consumer Confidence” issued by the University of Michigan. Additionally, the release of the “Retail Sales” index from the United Kingdom and the “GDP” index from the Canadian economy may result in heightened price volatility at the time of news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations