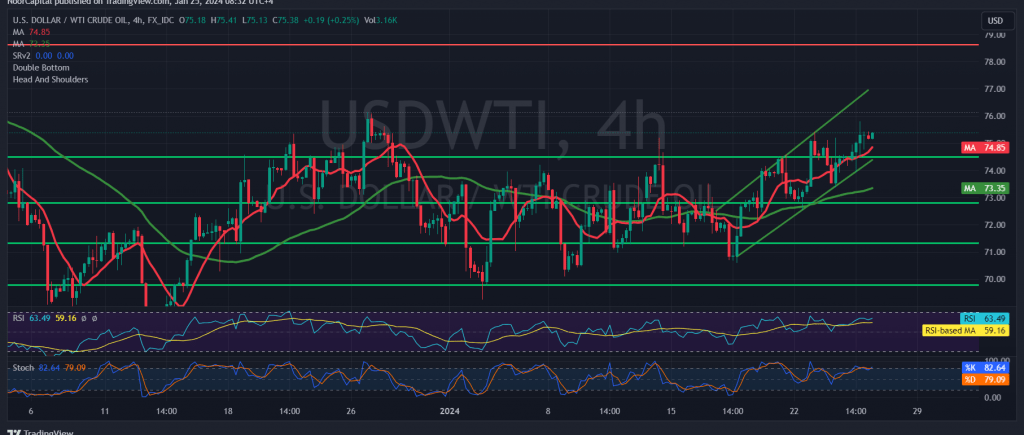

US crude oil futures prices have surged as anticipated, reaching the designated target in the previous trading session at $75.20 and coming within a few points of the subsequent target at $76.00. The recorded peak stands at $75.80 per barrel.

From a technical perspective, oil prices are holding steady above the support level of 74.30, with the simple moving averages providing positive reinforcement, affirming the continuity of the daily upward trend.

The ongoing upward trajectory remains valid as long as trading persists above 74.30, targeting 76.10 as the initial objective. Confirmation of a breach above the robust resistance level of 76.10 serves as a catalyst, bolstering the prospects for additional gains towards 76.85 and 77.30.

It’s important to note that slipping below 74.30 delays but does not nullify the potential for an ascent. In such a scenario, a retest of 73.80 may occur before renewed attempts at an upward movement. However, the closure of an hourly candle below 73.80 would promptly halt any upward endeavors, placing oil under significant negative pressure with a target of 73.00.

Investors should exercise caution today, given the anticipation of high-impact economic data from the Eurozone, including the European Central Bank Monetary Policy Committee statement, interest rate announcements, and the press conference by the President of the European Central Bank. Consequently, substantial price fluctuations may be observed during the news release period.

Furthermore, the level of risk may be elevated amid ongoing geopolitical tensions, potentially resulting in heightened price volatility. Prudent risk management is advised in the current market environment.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations