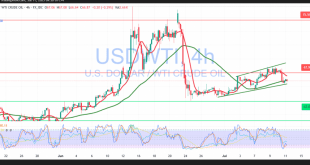

US crude oil futures prices achieved noticeable gains within the expected bullish context during the previous analysis, touching the first target of 70.25 to continue achieving gains for the official station targeted for the current ascending wave during the last report at 71.10, recording its highest level at 71.05 during the early trading of the current session.

Technically, the 50-day moving average continues holding the price, accompanied by positive signals coming from the RSI on the short time frames.

Therefore, the bullish scenario is still intact, provided that the breach of 71.30 is confirmed to enhance the chances of rising towards 71.70/71.80, and the gains may extend later to visit 72.40.

Activating the suggested bullish scenario requires daily stability above 70.15/70.00, trading below it that postpones the chances of a rise but does not cancel it, and we may witness a retest of the previously breached resistance, which turned to the 69.25 support level, 50.0% Fibo.

Note: Stochastic is trading around overbought areas.

| S1: 70.15 | R1: 71.35 |

| S2: 69.40 | R2: 71.80 |

| S3: 68.90 | R3: 72.50 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations