US crude oil witnessed a strong rise in futures prices within a positive outlook, as we expected, touching the official target of the previous technical report at 83.20, recording its highest level during early trading of the current session, $83.80 per barrel.

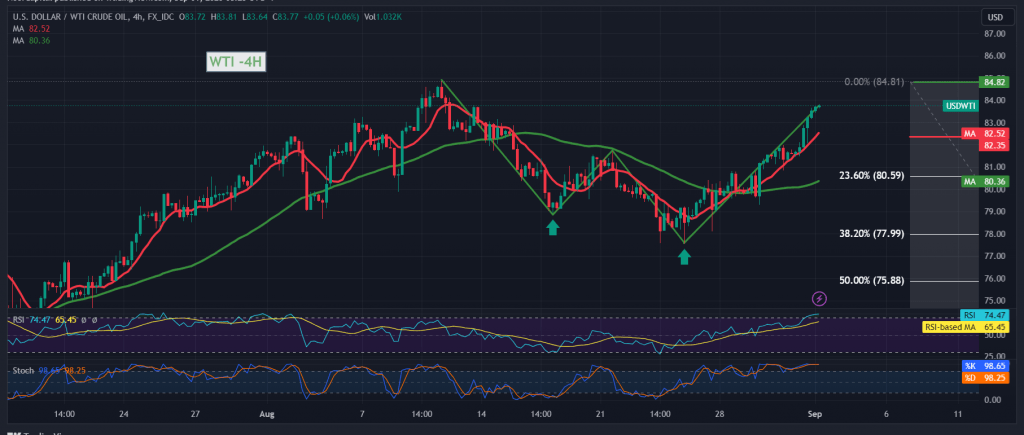

Technically, we find the price stable momentarily above the psychological barrier of 83.00, and in general, it succeeded in breaking the 82.30 resistance level, which was converted into a support level, in addition to the price receiving a positive incentive from the simple moving averages that support the continuation of the daily upward curve of prices.

We maintain our positive outlook, knowing that the breach of 83.80 is a motivating factor that increases and accelerates the strength of the daily upward trend, so we are waiting for 84.55 as the first target, and then 85.30 as the next official station, as long as daily trading remains stable above 82.30.

Trading stability below 81.00 with the closing of at least an hour candle can thwart the proposed scenario and lead oil prices to retest the 80.60 23.60% Fibonacci retracement as shown on the chart, before rising again.

Note: The risk level may be high.

Note: Today we are awaiting high-impact economic data issued by the American economy (US jobs data NFP, average wages, unemployment rate and manufacturing PMI), and from the Canadian economy, we are awaiting “Gross Domestic Product” and we may witness high volatility at the time the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations