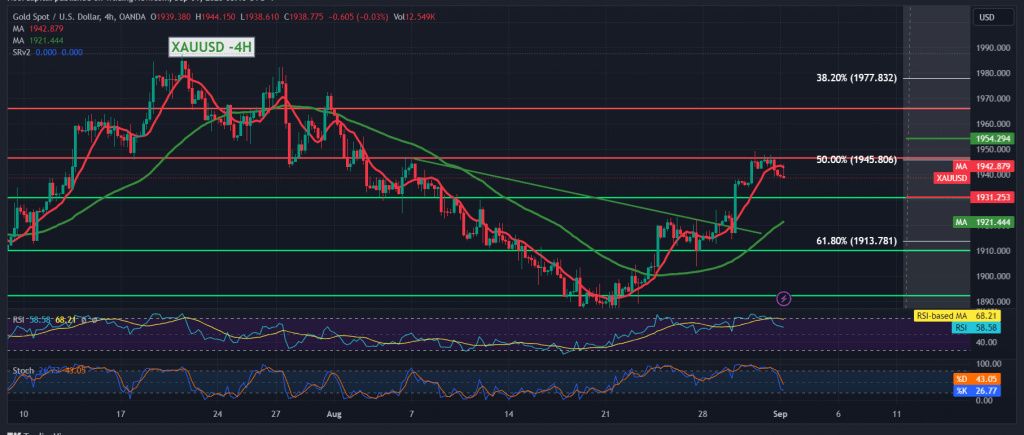

Gold prices found it difficult to break the pivotal resistance level published in the previous report at 1945, in which we explained how important it is to the current trading levels, to force gold prices to retest 1938.

Technically, the 50-day simple moving average still protects the price, and we find the Stochastic indicator around overbought areas.

We tend to return to the temporary bullish path, with intraday trading remaining above 1932, and most importantly 1929, targeting 1945, the 50.0% Fibonacci retracement, knowing that the success of gold prices in breaking the level above is capable of consolidating the gains so that we can wait for 1953 and 1965, respectively.

Only from below did the price consolidate below 1929 and close at least an hour candle. This puts the price under strong negative pressure whose target is 1913, the 61.80% correction, before determining the next price destination.

Note: Today we are awaiting high-impact economic data issued by the American economy (US jobs data NFP, average wages, unemployment rate and manufacturing PMI), and from the Canadian economy, we are awaiting “Gross Domestic Product” and we may witness high volatility at the time the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations