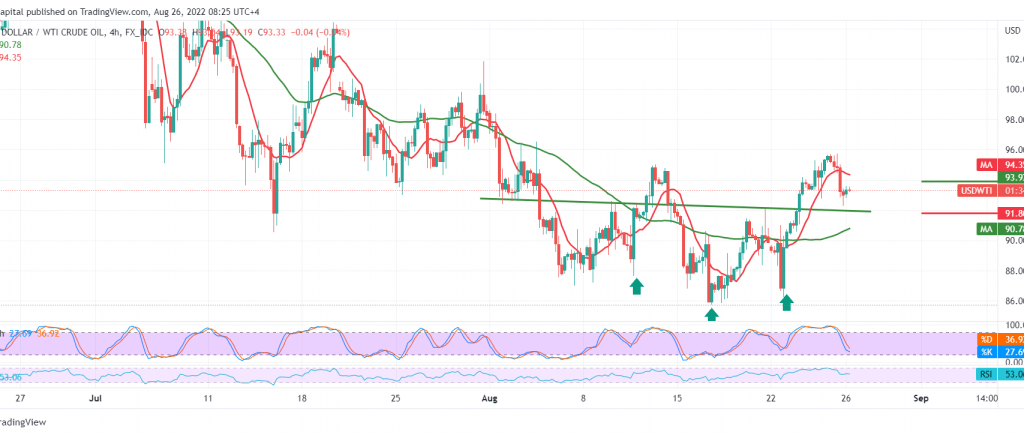

Mixed trading dominated the US crude oil futures prices during the previous trading session to maintain positive stability, recording a high of $95.72 per barrel.

Technically, we notice the negative signs coming from the stochastic that support a bearish bias in the upcoming hours, in addition to the decline of the bullish momentum on the short time frames.

We may witness a bearish tendency whose target is to retest 91.80/92.00 before attempts to rise again, knowing that the mentioned bearish tendency does not contradict the daily bullish trend, whose initial targets are around 95.70 once the breach of 93.90 is confirmed.

Note: the level of risk may be high.

Note: Throughout today’s session, the “Jackson Hole” economic forum is being held, and it has an essential impact on the markets, and we may witness random movements.

Note: We are awaiting the speech of “Jerome Powell” Chairman of the Federal Reserve later in today’s session, during “Jackson Hole” and we may witness high volatility in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations