We remained neutral and preferred to monitor the price behaviour for the second session in a row due to the conflicting technical signals, explaining that the confirmation of the bullish corrective bias that occurred yesterday depends on the consolidation above 1758, targeting 1761 and 1767 respectively, to record gold at its highest level at 1766.

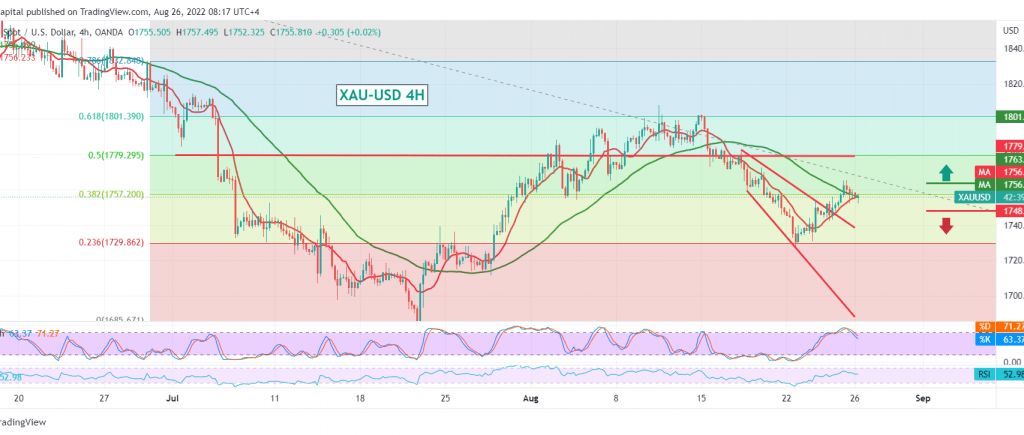

Technically and by looking at the 4-hour chart, we find gold hovering around the 50-day simple moving average, which is trying to push the price to the upside, accompanied by the RSI attempts to get bullish momentum on the short time frames; on the other hand, we find stochastic that provides Negative signals on the 4 hour time frame.

Therefore, we prefer to monitor the price behaviour for the third session in a row until the technical signals become clearer more accurately, to be waiting for the following:

Consolidation and stability above 1761 may be a catalyst that enhances the chances of touching 1764 and 1772, respectively.

Sneaking below 1747 is a negative pressure factor on the price, and we are waiting for an ounce of gold around 1740 and 1732.

Note: Throughout today’s session, the “Jackson Hole” economic forum is being held, and it has an essential impact on the markets, and we may witness random movements.

Note: We are awaiting the speech of “Jerome Powell” Chairman of the Federal Reserve later in today’s session, during “Jackson Hole” and we may witness high volatility in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations