US crude oil futures experienced quiet yet positive trading during yesterday’s US market holiday, reaching its highest level at $78.52 per barrel.

Technical Analysis Reinforces Upward Trend

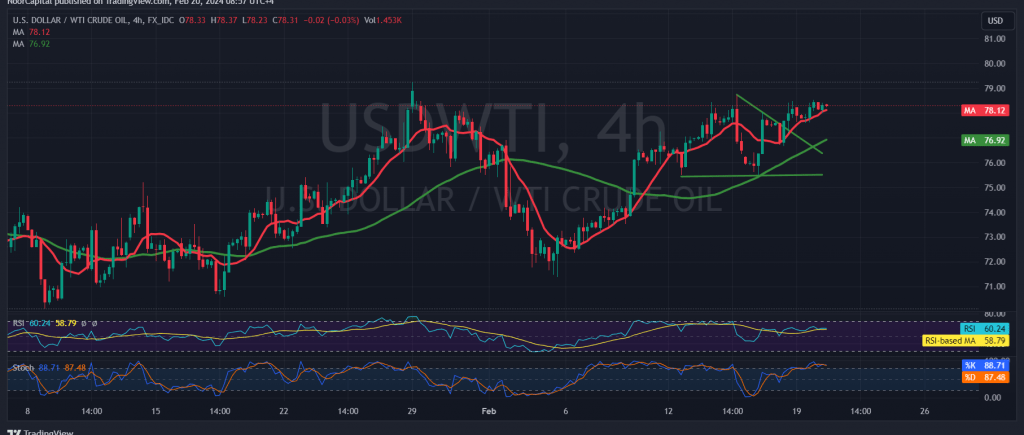

The technical outlook for oil prices remains unchanged, with trading continuing within an upward trend observed within the ascending price channel depicted on the 4-hour chart. Additionally, the presence of simple moving averages continues to bolster the daily upward trajectory of prices.

Key Support Level Maintains Bullish Momentum

As long as daily trading remains above the crucial support level of $77.80, the upward trend is expected to persist. The initial target stands at $78.70, with confirmation of breaching this level reinforcing and accelerating the strength of the upward trend. This opens the path towards $79.05 and $79.50, respectively.

Risk of Bearish Reversal with Support Breach

However, a drop below the support level of $77.80 could undermine the proposed scenario, potentially leading to a bearish trend. In such a scenario, oil prices may target a retest of $77.30 and $77.00.

Traders are advised to closely monitor support levels, particularly the critical threshold of $77.80, as it plays a pivotal role in determining the trajectory of oil prices. While the current momentum remains positive, a breach of support could trigger a shift towards bearish sentiment. Thus, vigilance and proactive risk management strategies are essential for navigating potential market fluctuations effectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations