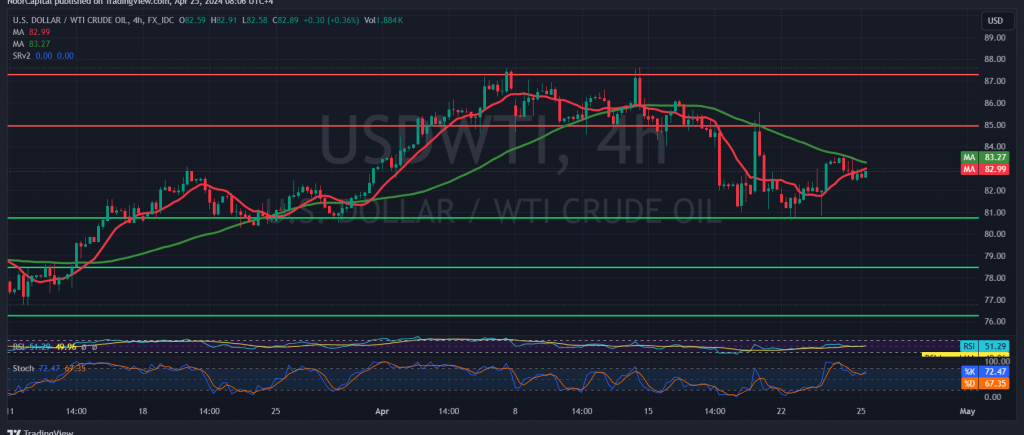

In the latest technical analysis, we maintained a neutral stance due to conflicting signals in the market. However, the continuation of a downward trend hinges on US crude oil futures prices remaining below the pivotal resistance level of $83.90, which saw a peak at $83.67 per barrel.

Examining the 4-hour chart, we note the negative influence of the 50-day simple moving average, particularly near the critical resistance level of $83.85. This convergence is further accentuated by the loss of upward momentum in the Stochastic indicator.

As such, if daily trading persists below $83.50, especially $83.90, the likelihood of a downward trajectory prevails for today’s session. Potential targets include $82.30, with a breakthrough opening the path towards $81.75.

It’s important to consider that consolidation above $83.90 could invalidate the bearish scenario, prompting a temporary recovery in oil prices, possibly reaching levels around $84.20 and $84.75 initially.

Additionally, today’s trading may experience heightened volatility due to the release of high-impact economic data from the US, including the Estimated GDP reading, pending home sales, and unemployment benefits. This, coupled with ongoing geopolitical tensions, underscores the potential for increased price volatility and risk.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations