US crude oil futures experienced a notable downturn in line with the projected bearish trajectory outlined in the previous technical report. The prices successfully reached both the initial target of 71.20 and the subsequent official target of 70.60, with the lowest recorded level hitting $70.65 per barrel.

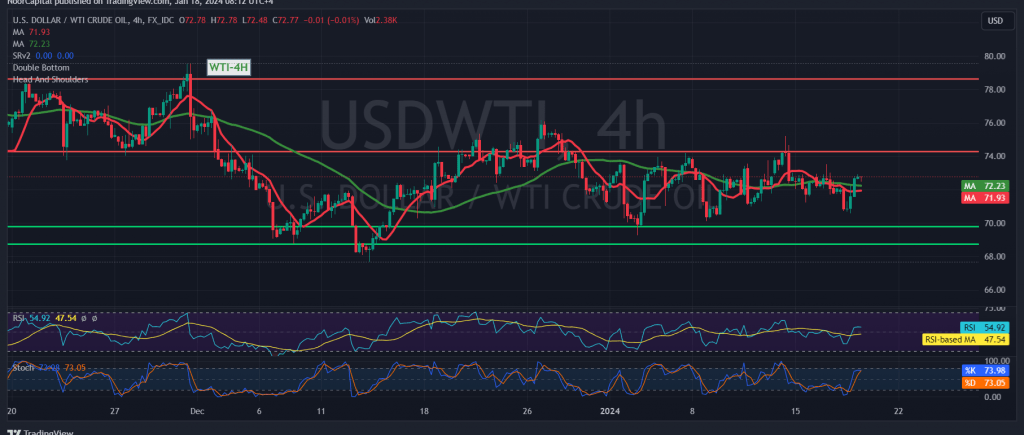

From a technical perspective, the recent decline prompted a significant rebound as the price touched the support floor at 70.60, fostering an upward momentum to test the resistance level at the psychological barrier of 73.00. A closer examination of the 4-hour timeframe chart reveals the return of the 50-day simple moving average to exert upward pressure on the price, supporting the potential for an ascent. Concurrently, the Stochastic indicator hovers around overbought areas.

Amidst these conflicting technical signals, a cautious approach is warranted, awaiting further price action to determine potential scenarios:

- Confirmation of the Upward Trend:

- Dependent on the price holding above the psychological barrier resistance at 73.00, and, crucially, above the primary resistance at the current trading level of 73.50.

- Successful adherence to these levels could lead to a robust upward rally, targeting levels such as 74.40 initially and potentially extending towards 75.40.

- Resumption of the Downward Trend:

- Failure to breach the 73.50 resistance, accompanied by a return of trading stability below 72.00, may signal a return of the downward trend.

- Downside targets include 71.30 and 69.80.

Warning: The inherent risks in the market are elevated, especially amid ongoing geopolitical tensions, possibly resulting in heightened price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations