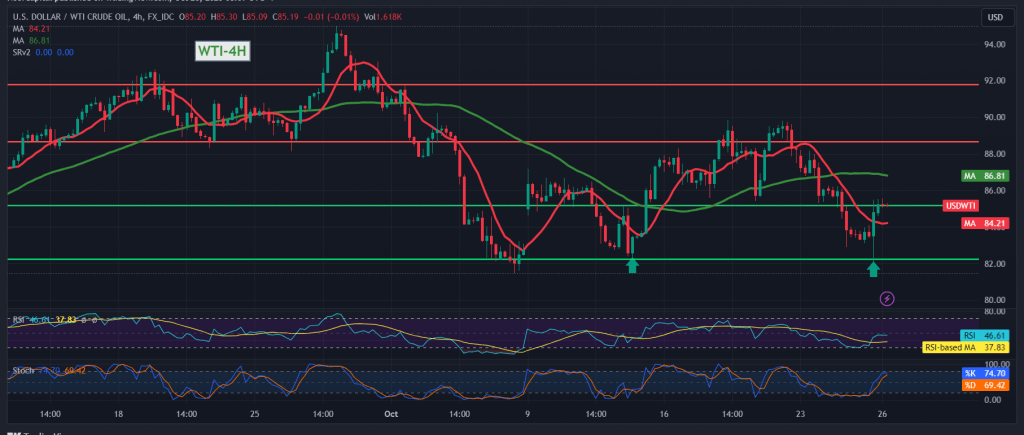

US crude oil futures prices declined significantly during the previous trading session within the expected downward trend, touching the official target station at 82.40, recording its lowest level at $82.15 per barrel.

Technically, when we look closer at the 240-minute time frame chart, we notice the 50-day simple moving average trying to push the price higher, accompanied by attempts by the 14-day momentum indicator to gain more upward momentum.

We tend to be positive in the coming hours, but only if we witness the price consolidating above the resistance level of 85.35. This may encourage the price to head towards 86.45 and 86.80, respectively.

Only reading stability below 83.10 will immediately stop the attempts to rise and lead oil prices to resume the downward trend, with targets starting at 82.00 and 81.10.

The risks are high.

Note: Today we are awaiting high-impact economic data issued by the Eurozone (European Central Bank Monetary Policy Committee statement, European Central Bank press conference, interest rates on the euro)

In the US, (preliminary estimates of gross domestic product).

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations