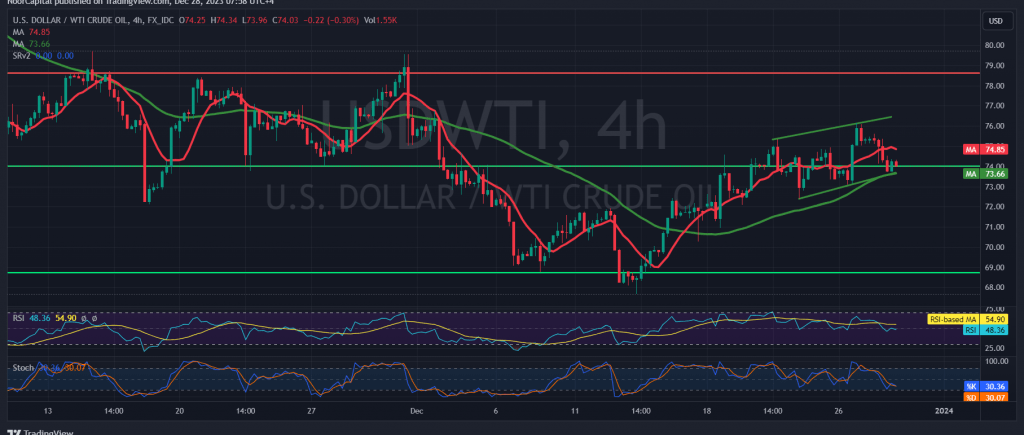

US crude oil futures prices witnessed a downward trend during the previous trading session, invalidating the expected bullish scenario in which we relied on trading bases above 73.70 at the time of writing the technical report.

Technically, by looking at the 4-hour time frame chart, we find that oil prices recorded their lowest level around 73.77, trying to stabilize positively above it. The mentioned level meets around the 50-day simple moving average, supporting the return of the upward bias. On the other hand, we find the Stochastic indicator providing negative signals and losing upward momentum significantly. gradual.

With conflicting technical signals, we prefer to monitor price behavior to be faced with one of the following scenarios:

Confirmation of breaking 73.30 leads oil to a downward path, its targets starting at 72.60 and extending to visit 72.50, while the price’s success above maintaining positive stability and cohesion above the aforementioned support, in addition to the return of trading stability above 74.50, may enhance gains towards 75.20 and 76.30.

Warning: Risk level is high.

Warning: The level of risk may be high amid continuing geopolitical tensions and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations