The previous trading session saw mixed activity in US crude oil futures contracts, with prices touching the official target at $80.40 per barrel before retracing slightly.

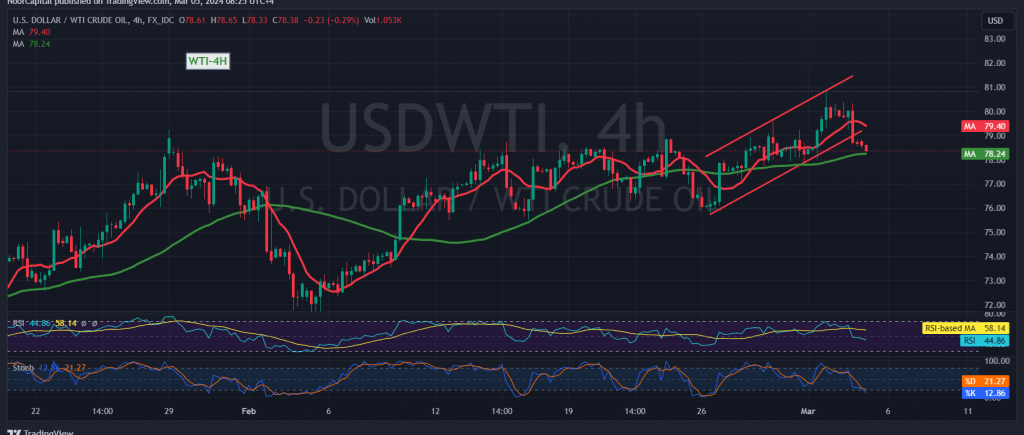

Technically, the resistance level at $80.40 exerted downward pressure on oil prices, prompting a temporary retreat. Currently, prices are hovering near the lower end of the spectrum around $78.40. Analysis of the 4-hour chart reveals negative signals from the Stochastic indicator, indicating a loss of bullish momentum as depicted on the 14-day momentum indicator.

In the near term, we may anticipate a bearish trend aiming to retest support at $77.70. It’s crucial to monitor price action around this level, as a break below it could extend losses towards the next support at $77.00.

However, it’s important to note that the bearish momentum does not negate the overall upward trend. Official targets remain around $81.00 and $81.75 once prices consolidate above the $80.40 resistance level.

Investors should exercise caution, especially with high-impact economic data from the American economy, particularly the Services Purchasing Managers’ Index issued by the ISM, expected today. Geopolitical tensions also contribute to heightened risk and potential price volatility.

while short-term bearish pressures may be observed, the broader uptrend remains intact, contingent upon key support and resistance levels. Vigilance and risk management are paramount in navigating the current market environment.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations