The recent trading sessions for US crude oil futures contracts showcased a positive trend, aligning with the anticipated bullish context and achieving the initial target set forth in the previous report at $79.25, with a peak at $79.60 per barrel.

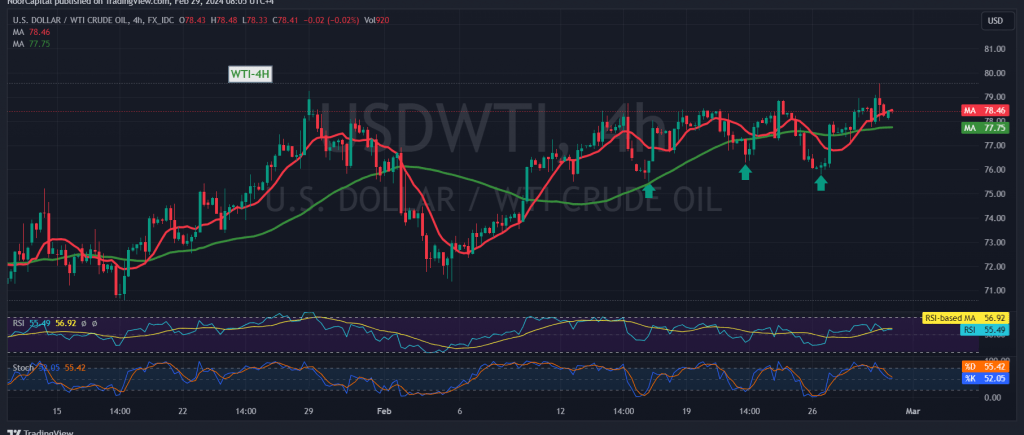

In today’s technical analysis, we maintain a positive outlook, albeit with caution. Our optimism is underpinned by the stability of intraday trading above the psychological support level of $78.00, and more broadly, stability above $77.65. Additionally, the 50-day simple moving average continues to provide support, coinciding with efforts from the Stochastic indicator to counteract negative signals.

Consequently, there is potential for the resumption of the upward trend, with an initial target set at $79.45. A breakthrough at this level would bolster and accelerate the strength of the upward trajectory, paving the way for a visit to $80.00, a highly anticipated milestone. Further targets may extend towards $80.40 thereafter.

Conversely, a breach below $77.55 would nullify the activation of the proposed scenario, triggering a bearish tendency in oil prices, with targets set at $76.80 and $76.50 before any attempted recovery.

A word of caution: Today’s trading activity may witness heightened volatility owing to the impending release of high-impact economic data from the American economy, specifically the annual and monthly basic personal consumption spending prices, along with the weekly unemployment benefits. Furthermore, the persistent geopolitical tensions elevate the risk level, potentially leading to increased price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations