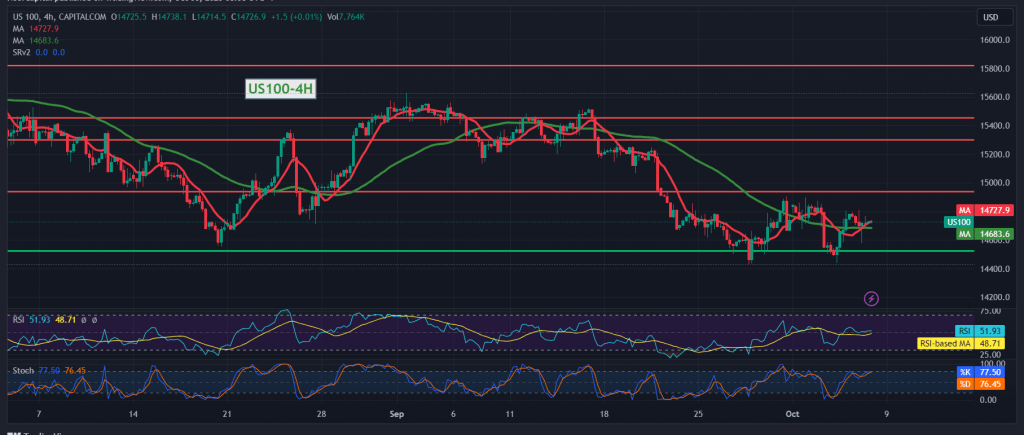

Mixed trades that tended to be positive dominated the movements of the Nasdaq index, recording its highest level during the previous trading session at 14810.

On the technical side today, we are leaning towards positivity, but with caution, relying on the clear positive momentum signals on the 14-day momentum indicator, and this comes in conjunction with the return of the simple moving averages to carry the price from below.

Therefore, the upward trend is the most preferred during the day, with trading remaining above 14600, targeting 14830 as the first target, and then 14930, knowing that breaching 14930 extends the gains towards 15040.

From below, the return of trading stability and price consolidation below 14600 puts the index under negative pressure with an initial target of 14475.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations