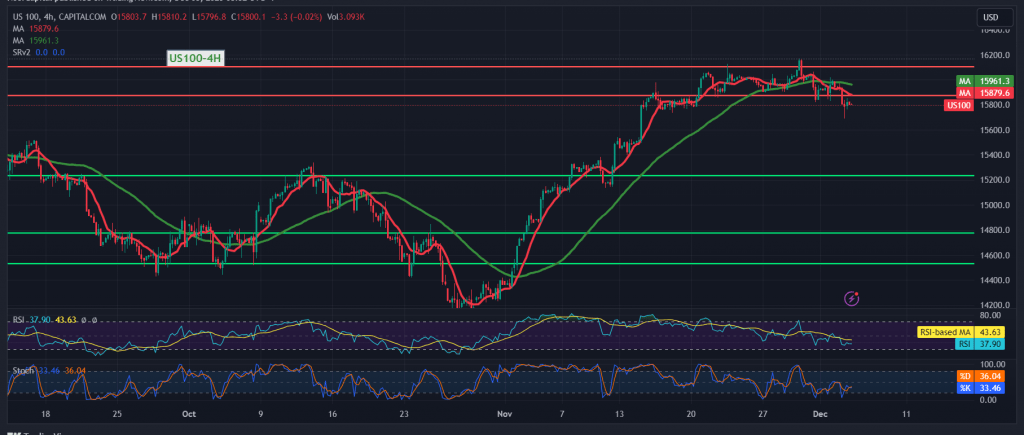

For the third consecutive session, the Nasdaq index faced challenges in breaking above and sustaining stability beyond the robust resistance level of 16060. This led to notable negative trading in the previous session after failing to maintain positive stability above 15940, resulting in a decline to 15860 and reaching its lowest level at 15822.

Technically, the simple moving averages continue to act as an impediment to the index, exerting downward pressure on the price. Additionally, trading stability below the previously breached support level of 15980, now acting as resistance, adds to the negative sentiment.

There is a possibility of a bearish trend during today’s session, targeting 15810. Breaking this level could extend the losses toward 15700, provided intraday trading remains below 15980. On the upside, consolidation above the main resistance of 16060 could reverse the trend upward, with a target of 16175.

Warning: Risks are high.

Warning: Today we are awaiting high-impact economic data from the American economy, including the Manufacturing Purchasing Managers’ Index issued by the ISM and a press talk by the Chairman of the Federal Reserve. Consequently, there may be high price volatility at the time of news release.

Warning: The level of risk is high amid continuing geopolitical tensions, and there may be high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations