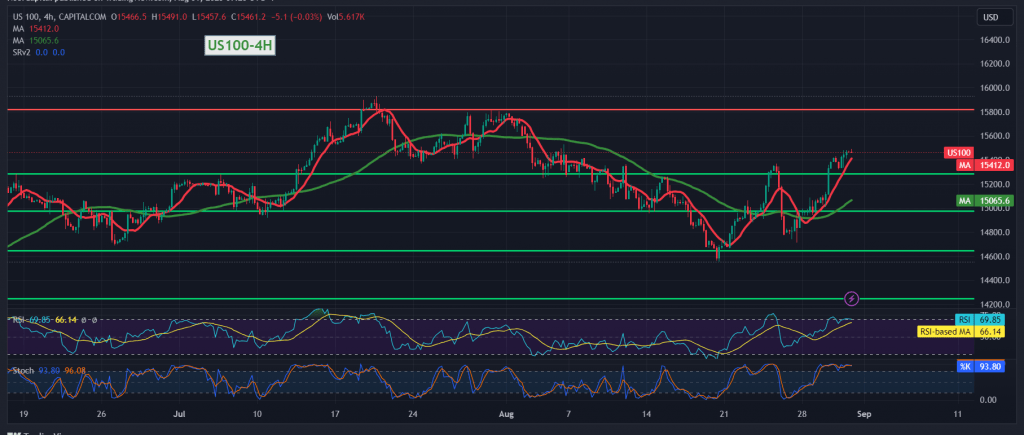

Positive trading dominated the movements of the Nasdaq index during yesterday’s US trading, with a gradual rise towards the first expected target of 15,550, only to record the highest of 15,490.

On the technical side, the daily trend is still inclined to the upside, relying on confirmation of the indicator’s success in achieving a base above the support level of 15,360 and, more importantly, 15,320, accompanied by the positive motivation of the simple moving averages.

Therefore, the bullish scenario remains valid and effective, knowing that breaching 15,530 extends the index’s gains as we wait to touch 15,590, the first target, and then 15,660, the next official station, whose targets may later extend towards 15,700.

We remind you that the return of trading stability again below 15,320 completely invalidates the activation of the proposed scenario, and we’ll witness a trading session in negative areas with an initial target of 15,260.

Note: The risk level may be high.

Note: Today we are awaiting high-impact economic data issued by the US economy, “Personal Consumption Spending,” and we may witness high price fluctuation when the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations