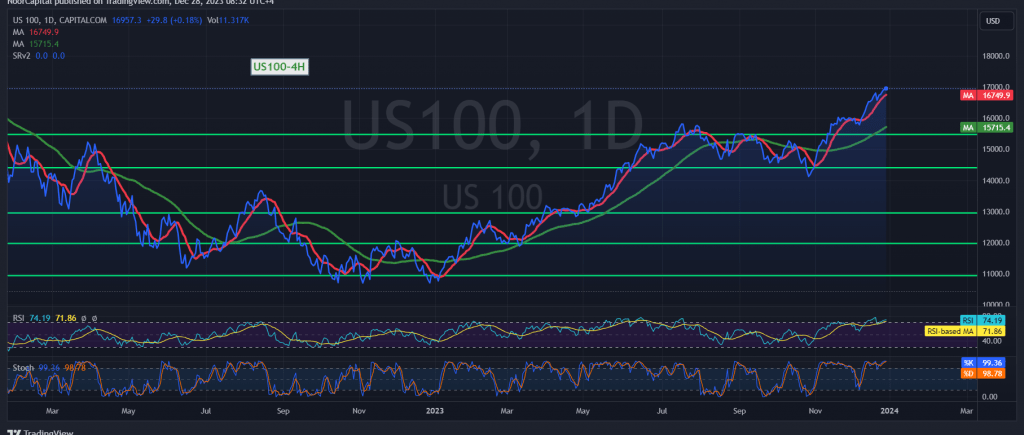

The Nasdaq index succeeded in touching the first official target required to be achieved during the previous report, located at 16980, recording the highest at 16965.

On the technical side today, we are leaning towards positivity, relying on the indicator continuing to receive positive motivation from the 50-day simple moving average. This comes in conjunction with the positive signals coming from the relative strength index, stable above the 50 midline.

From here, with the stability of trading above 16885, the upward trend remains valid and effective, targeting 17,000 as the first target, and breaching it increases the strength of the upward trend, so that the path is directly open towards 17040, and the gains may extend later towards 17110.

The return of trading stability without support at 16885 postpones the activation of the proposed scenario and places the index under temporary negative pressure with the aim of retesting 17110.

Warning: The level of risk is high amid continuing geopolitical tensions, and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations