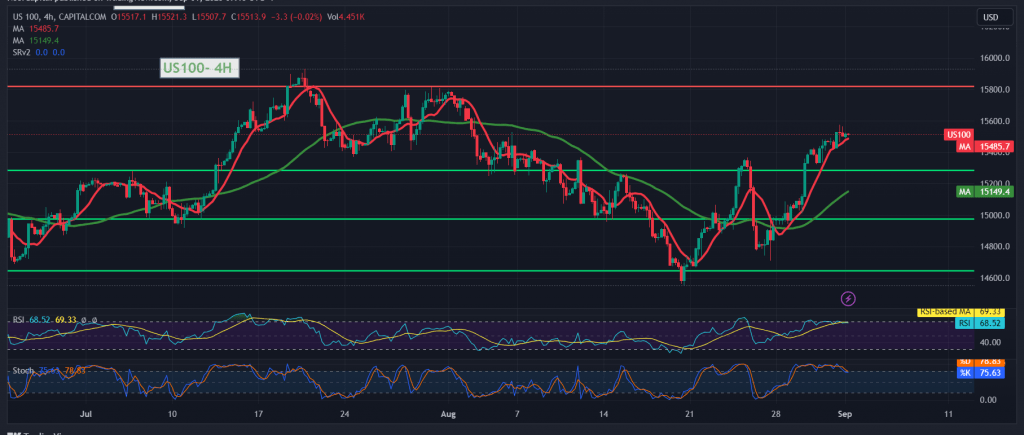

The Nasdaq index achieved the first target required to be touched during the previous technical report at 15,530, approaching a few points ahead of the second target of 15,590, only to record its highest at 15,575.

On the technical side, the daily trend is still inclined to the upside, relying on confirmation of the indicator’s success in achieving a base above the 15,430 support level, accompanied by the positive motivation of the simple moving averages.

Therefore, the bullish scenario remains valid and effective, knowing that breaching 15,580 extends the index’s gains, as we wait for it to touch 15,655, the first target, and then 15,710, the next official station.

We remind you that the return of trading stability again below 15,430 completely invalidates the activation of the proposed scenario and we are witnessing a trading session in negative areas with an initial target of 15345 and 15270.

Note: The risk level may be high.

Note: Today we are awaiting high-impact economic data issued by the American economy (US jobs data NFP, average wages, unemployment rate and manufacturing PMI), and from the Canadian economy, we are awaiting “Gross Domestic Product” and we may witness high volatility at the time the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations