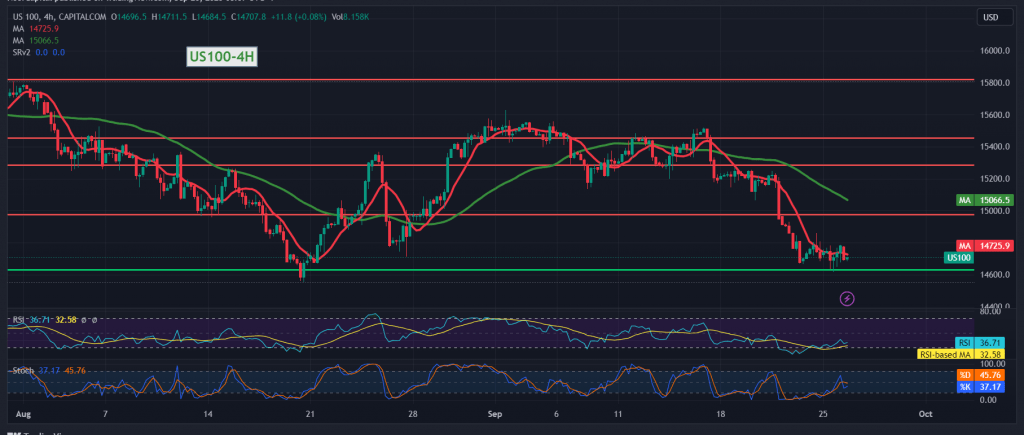

A downward trend dominated the movements of the Nasdaq index within a negative outlook, as we expected during the previous trading session, touching the official target station of 14,610, recording its lowest level of 14,618.

On the technical side today, with a closer look at the 4-hour chart, negative pressure still comes from the simple moving averages and negative signals on the Stochastic indicator.

Hence, with intraday trading remaining below the resistance level of 14,790, the bearish scenario remains the most preferable during today’s trading session, targeting 14,625, and breaking the aforementioned level extends the index’s losses, as we wait for 14,540.

Trading stability and price consolidation above 14,790 will immediately stop the proposed bearish scenario and lead the index to retest 14,875 and then 14,960.

Note: The 14-day momentum indicator is trying to obtain positive signals, and we may witness some fluctuation until we obtain the official direction.

Note: Today we are awaiting highly sensitive economic data issued by the US economy, “Consumer Confidence,” and we may witness high volatility when the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations