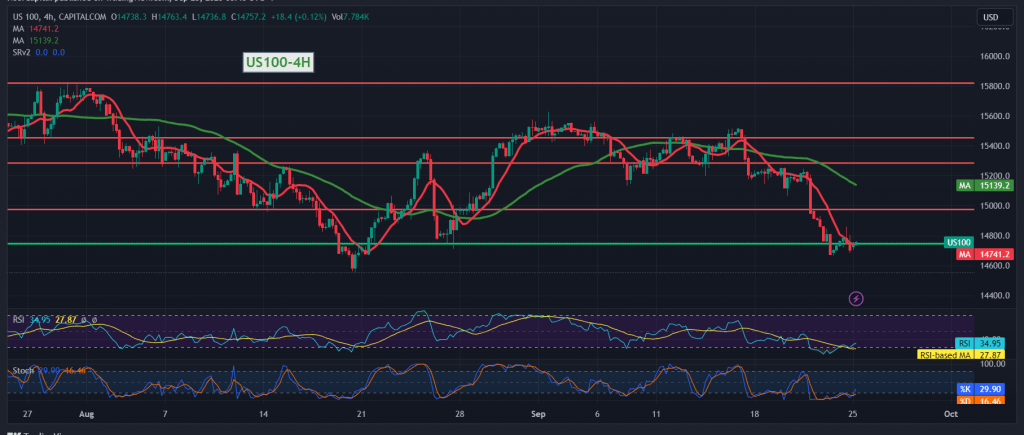

Negative pressure continues to control the movements of the Nasdaq index within the expected bearish context during the previous trading session, recording its lowest level at 14,668.

On the technical side today, with a closer look at the 4-hour chart, negative pressure still comes from the simple moving averages and negative signals on the Stochastic indicator.

Hence, with the stability of intraday trading below the resistance level of 14,860, the bearish scenario remains the most preferable during today’s trading session, targeting 14,660, an expected target, and then 14,610.

Only from above, the return of trading stability and price consolidation above 14,860 will immediately stop the proposed bearish scenario and lead the index to retest 14,960 and then 15,050 initially.

Note: The level of risk may be high

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations